Filipino dual citizen, partners charged in $650M real estate Ponzi scam

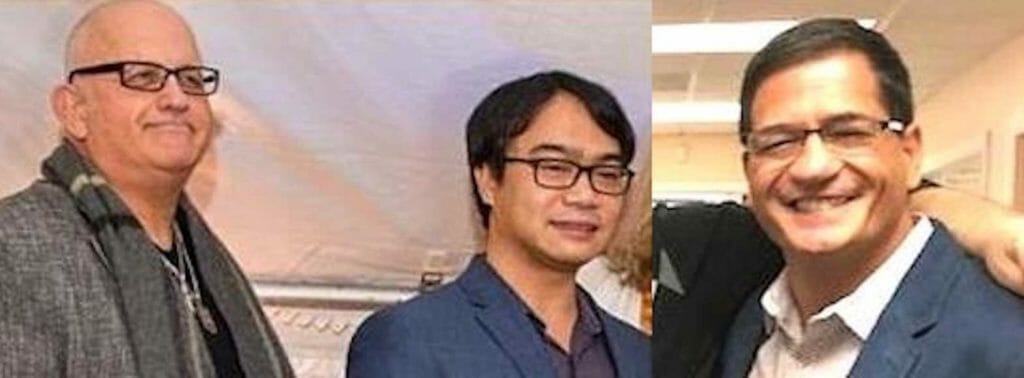

Rey E. Grabato II of Hoboken, New Jersey and the Philippines (middle) and Thomas Nicholas Salzano face an 18-count indictment for fraud; Arthur S. Scuttaro (right photo) pleaded guilty to a conspiracy charge. NRIA WEBSITE/FACEBOOK

NEWARK, New Jersey – The Filipino dual-citizen president and a top officer of a real estate investment firm were indicted for allegedly defrauding more than 2,000 investors in a $650-million Ponzi scheme and conspiring to evade $26 million in tax liabilities, U.S. Attorney Philip R. Sellinger announced Oct. 12.

Rey E. Grabato II, 43, of Hoboken, New Jersey and the Philippines, president of National Realty Investment Advisors LLC (NRIA), and Thomas Nicholas Salzano, 64, of Secaucus, New Jersey, the firm’s shadow chief executive officer, face an 18-count indictment, with securities fraud, conspiracy to commit securities fraud, wire fraud, conspiracy to commit wire fraud and conspiracy to defraud the United States.

Salzano is also charged with two counts of aggravated identity theft, two counts of tax evasion, and five counts of subscribing to false tax returns. He was arrested Oct. 12, 2022. Grabato remains at large.

The former head of sales at NRIA Arthur S. Scuttaro, 62, of Nutley, New Jersey, pleaded guilty before U.S. District Judge Evelyn Padin in Newark federal court to one count of conspiracy to commit securities fraud in the same scheme. His sentencing is scheduled for Feb. 23, 2023.

According to court documents, from February 2018 through January 2022 Salzano and Grabato defrauded investors and potential investors of $650 million through lies, deception, misleading statements, and material omissions.

These included false representations about NRIA’s financial position, how the defendants and their conspirators used fund investor money, and Salzano’s managerial role at NRIA and his history of fraud.

The defendants allegedly conducted an aggressive multiyear, nationwide marketing campaign that involved thousands of emails to investors; advertisements on billboards, television, and radio; and meetings and presentations to investors.

Salzano led and directed the marketing campaign meant to mislead investors into believing that NRIA was a solvent business that made significant profits. In reality, NRIA made little to no profits and operated as a Ponzi scheme, which was kept afloat by new investors. Despite investing almost none of their own capital into the business, the defendants misappropriated millions of dollars of investor money.

Salzano concealed his true managerial role at NRIA while using Grabato as a stand-in CEO in an effort to avoid scrutiny by investors of Salzano’s prior guilty plea to defrauding small businesses in Louisiana through a large telecommunications company.

Salzano and Grabato also orchestrated a separate conspiracy to defraud the IRS in its effort to collect $26 million in outstanding taxes Salzano owed to the U.S. Treasury. Salzano and Grabato are alleged to have lied to the IRS, used a web of nominees, opened bank accounts in the names of phony entities, and used false and fraudulent company documents.

The conspiracy to commit securities fraud and conspiracy to defraud the United States counts charged in the indictment both carry a maximum penalty of five years in prison and a $250,000 fine.

The securities fraud count carries a maximum penalty of 20 years in prison and a $5 million fine. The wire fraud conspiracy and wire fraud counts are both punishable by a maximum of 20 years in prison and a $250,000 fine. The tax evasion counts both carry a maximum of five years in prison and a $100,000 fine.

The subscribing to false tax return counts each carries a maximum of three years in prison and a $100,000 fine. The aggravated identity theft counts carry a mandatory sentence of two years in prison, which must be served consecutively to any other sentence imposed.

“These defendants schemed to create a high-pressure, fraudulent marketing campaign to hoodwink investors into believing that their bogus real estate venture generated substantial profits,” U.S. Attorney Sellinger said in a press release. “In reality, their criminal tactics were straight out of the Ponzi scheme playbook so that they could cheat their investors and line their own pockets.

“This was a brazen scheme of staggering proportions,” Tammy Tomlins, IRS Criminal Investigation Acting Special Agent in Charge of the Newark Field Office, said in the same release. “These defendants prioritized their own greed, stealing $650 million from investors, while conspiring to evade $26 million in tax liabilities.

In a separate civil action, the Securities and Exchange Commission filed a complaint in the District of New Jersey against Salzano, Grabato, Scuttaro, and others based on the allegations alleged in the indictment and information.