Tax savings for families you should know about

San Francisco Assessor Carmen Chu greeting attendees at a previous Family Wealth Seminar. CONTRIBUTED

SAN FRANCISCO — As you prepare for your income tax filing for this year, please remember to bring your property tax bills and payments to your accountants or tax filers. Property taxes paid are typically tax deductible, which means those expenses can be deducted from your taxable income to lower your income tax dues. Other tax-deductible items may include:

- Homebuyer tax credit, mortgage interest

- IRA contributions

- Education costs, student loan interest

- Medical Savings Account (MSA) contributions

- Self-employed health insurance or other medical expenses

- Charitable contributions/donations

- Childcare cost

- Job and moving expenses

Income Tax Credits

Moreover, the maximum Earned Income Tax Credits (EITC) for this year has increased. Families with income under $54,998 may be qualified to receive a tax credit of up to $6,444. Please see below for more details on the maximum tax credit:

- $6,444 with three or more qualifying children

- $5,728 with two qualifying children

- $3,468 with one qualifying child

- $520 with no qualifying children

Property Tax Savings

Are you planning to pass on property to your children? Did you know that California tax laws allow parents to transfer ownership to their children (and vice versa) without reassessing the property to market value?

Prop 13, passed in 1978, caps the yearly assessment increase on a property at 2%. However, when there is a change in ownership, properties are generally reassessed to market value, but there are exceptions. If a claim for Prop 58 tax exclusion is submitted, property owners may be able to keep the current assessed value on the property. If that’s the case, children receiving the property may continue to pay property taxes at their parents’ level. Last year, the Assessor’s office granted close to 2,000 Prop 58 exclusions for transfers between parents and children.

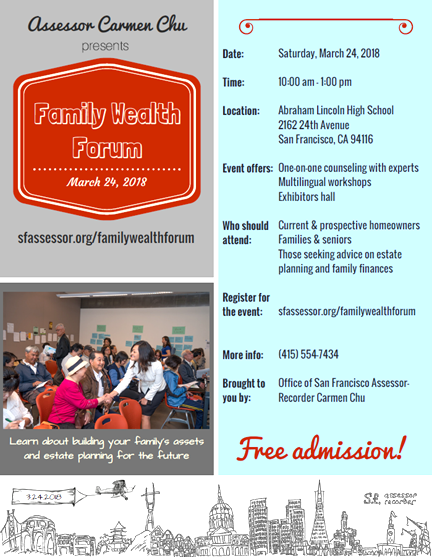

If you are interested in learning more on tax savings, estate planning and family asset building, please join Family Wealth Forum on March 24, 2018 (Sat) at Lincoln High School (2162 24th Avenue, San Francisco, CA 94116). The event is free and Spanish translation is provided.

Visit sfassess.org/familywealthforum to register today!

Carmen Chu is the Assessor-Recorder of the City & County of San Francisco.