Thousands of people in PH could receive an extra Christmas present this year by switching to new money transfer services

The high costs of sending money home mean Filipinos living abroad are losing out on Christmas gifts when sending money home.

Each year over US$31 billion is sent into the Philippines in remittances and the final week before Christmas is one of the busiest times to send money. The World Bank reports that the average cost of sending money is around 7.21%.

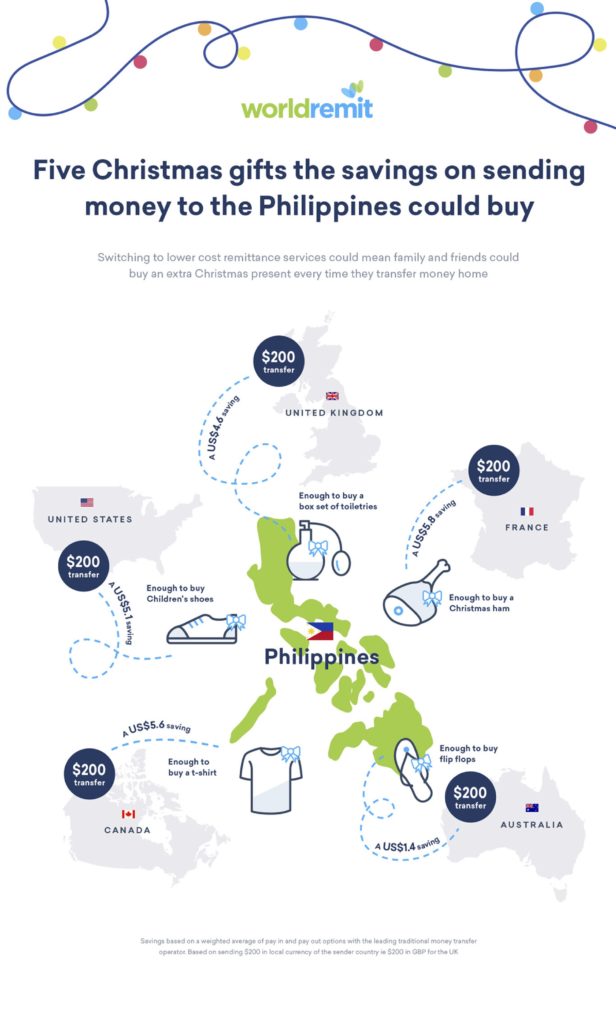

WorldRemit research revealed that switching to lower cost channels could mean thousands of Filipinos could receive an extra Christmas present this year. The savings were highest when sending from Canada to the Philippines – enough to buy a T-shirt back home.

With many Filipinos in Canada earning around USD 6-10 an hour, these high costs mean the diaspora are having to work up to an hour more than necessary to cover the elevated costs of sending with traditional channels.

Ismail Ahmed, CEO of WorldRemit commented:

“It’s important to consider that the cost of sending money goes far beyond the transactional cost. Traditional methods mean travelling to an agent to pay in money, taking time off work to do so knowing your family and friends receiving the money will have to do the same.

By sending money from one mobile to another instantly, we can save people not just money, but also time.”

Considering that it costs almost USD 3 (PHP150) to get into Makati from the suburbs of Manila and can take a least an hour there and back, picking up cash can also bring high costs for the recipient.

WorldRemit data suggests that most of their customers send between three and four transactions a month to the Philippines so the savings across the month of December could be even greater. The savings on travel and time alone could be enough to buy a Christmas ham.

Ismail Ahmed, added:

“We see that being able to send money more frequently without paying high costs and wasting time brings families and friends closer together even when living hundreds of miles apart. So we hope we can give people more time with family and friends this Christmas.

Notes

The savings were calculated based on sending the equivalent of $200 in the local currency of the sender country using a weighted average of pay-in and pay-out methods for the leading traditional money transfer operator compared to WorldRemit.

Sources

World Bank Remittance prices data

About WorldRemit

WorldRemit is changing the way people send money.

WorldRemit was founded in 2010. The Chief Executive Ismail Ahmed – a UK based entrepreneur from Somaliland – saw the opportunity to give customers a better service by offering faster, lower-cost and more secure digital money transfers compared to traditional ‘bricks and mortar’ agents.

The company has grown quickly: it has ranked in the Sunday Times Tech Track top 100 list of fastest growing tech companies for the past two years in a row. Backed by Accel Partners and TCV – investors in Facebook, Spotify, Netflix and Slack. Dr Ahmed was recently voted the third most influential person in the 2018 Powerlist of 100 people, which recognises those of African and African Caribbean heritage. In 2017 WorldRemit was recognised by the FT and the IFC as the UK’s most Transformative Business in the Transformational Business Awards.

WorldRemit’s global headquarters are in London, UK with offices in the United States, Canada, South Africa.