Wall Street stocks have a year of bust and boom so far

Wall Street’s giddiness in recent weeks stands in stark contrast to the pandemic panic of one year ago.

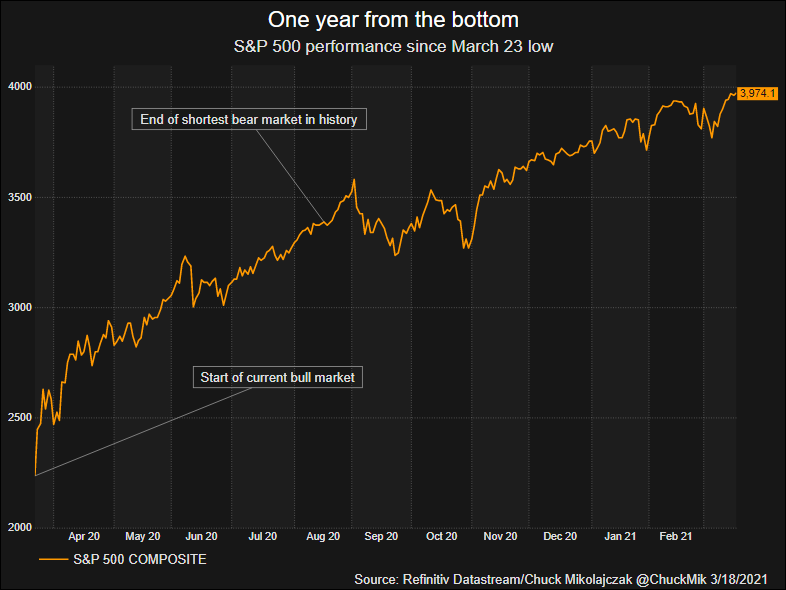

U.S. stocks on Tuesday will mark the one-year anniversary of the market low as the spread of the COVID-19 and government lockdowns began to crush economic activity, before massive government and central bank stimulus plus the development of vaccines fueled a stunning, if uneven, rebound.

As investor optimism grew, stocks began to recover from the selloff that ended an 11-year bull market, history’s longest.

The S&P 500 bottomed by closing at 2237.40 on March 23, and topped the Feb. 19, 2020 bull-market high on Aug. 18, when the index ended the session at 3389.78. That high marked the end of the shortest bear market ever and confirmed that on March 23 a new bull had been unleashed.

Photo Credit: Reuters

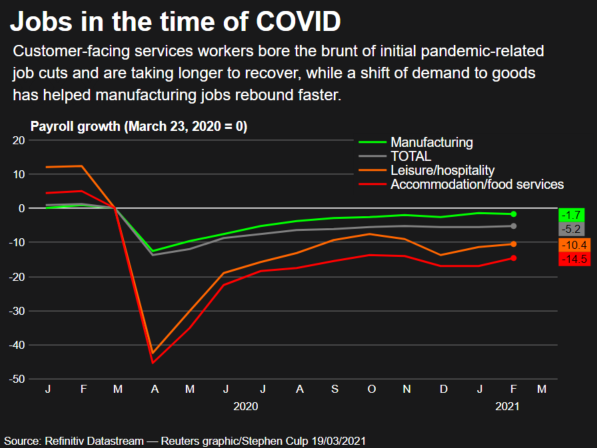

Initial lockdowns hit customer-facing services sectors the hardest as social distancing mandates to curb COVID’s spread shuttered restaurants and slammed the travel and leisure industry.

Jobs in these sectors – typically on the lower end of the wage scale – evaporated overnight, and as new coronavirus infections spiked and abated, those jobs have been slow to return.

Conversely, the shutdown caused consumer demand to shift from services to goods, boosting resilience of U.S. factories and prompting a restoration of manufacturing jobs that outpaced the whole.

Photo Credit: Reuters

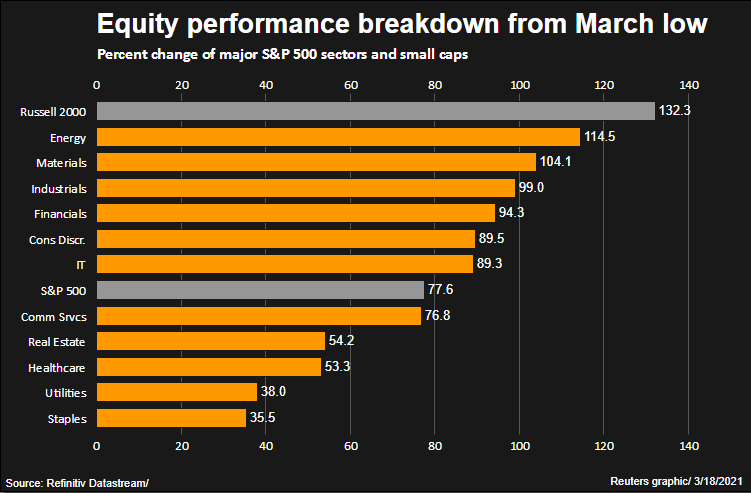

Along with the stimulus supplied by the U.S. Federal Reserve and the government, stocks worked their way off the low thanks in part to the start of vaccine rollouts and optimism that economic reopenings were on the horizon.

But companies that commanded attention during the beginning of the pandemic, so called “stay-at-home” plays such as Amazon, Zoom Media and Teladoc saw their fortunes begin to turn in the latter stages of 2020, with cyclical sectors such as energy, materials and small cap stocks garnering more favor.

Photo Credit: Reuters

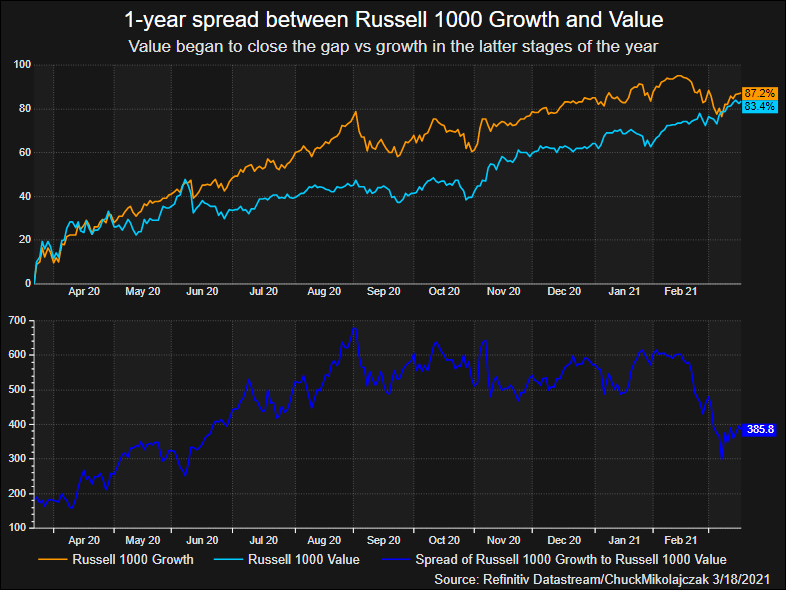

As optimism about reopenings began to rise, so did investor appetite for stocks that traditionally do well as an economy recovers from a recession. Many of those stocks fall into a “value” profile as they were largely ignored for bigger “growth” names in sectors such as technology and communication services.

That change in tenor helped value stocks close what had been a widening gap versus the outperformance of growth stocks over the past several years.

Photo Credit: Reuters

Uncertainty about the medium- or long-term recovery prognosis saw several pivots between stay-at-home and reopening plays.

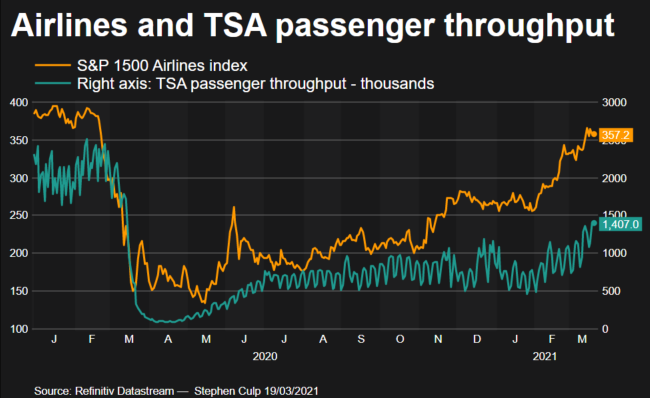

For instance, the equities market looked beyond grim current conditions and toward an expected recovery in commercial air travel, which can be seen by comparing air traffic data with airline stocks. Investors clearly see the battered sector taking off despite persistently low passenger numbers courtesy of the Transportation Safety Administration (TSA).

Photo Credit: Reuters

The housing market has been the star of the U.S. economic recovery, rebounding beyond pre-pandemic levels as the hunt for lower population density and home office space, along with historically low mortgage rates, sent demand soaring, home prices surging and supply of homes on the market to all-time lows.

Housing stocks have also handily outperformed the broader market since its nadir. A year later, the Philadelphia SE Housing index is up nearly 150%, almost double the S&P 500’s advance over the same time period.

The sector’s strength is also a reminder of who suffered the worst of the largest economic downturn since the Great Depression, as lower income Americans typically rent and are less likely to be prospective home buyers.

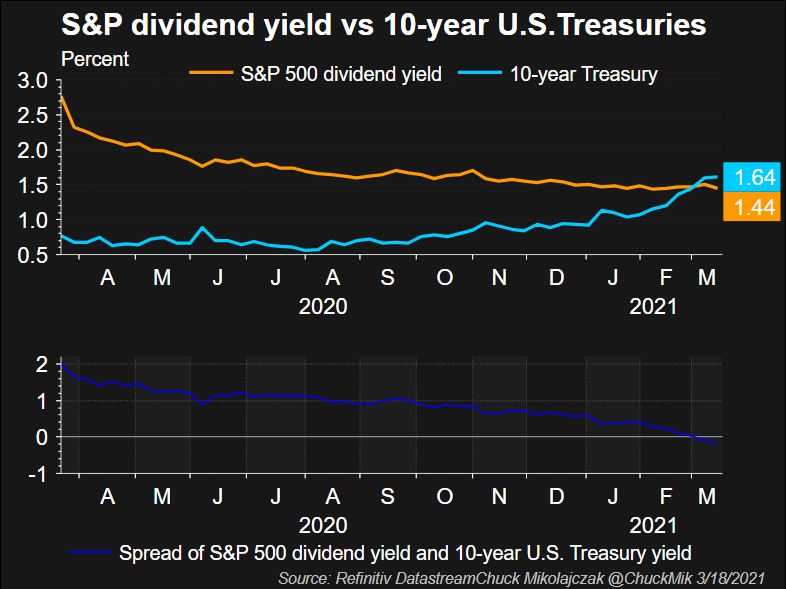

Stocks also benefitted from what was referred to as “TINA,” or “there is no alternative” as the Fed’s easy monetary policy kept Treasury bond yields historically low, which also pushed home mortgate rates to their lowest level ever. The yield on the benchmark 10-year U.S. Treasury note was less than the dividend yield for the S&P 500 for some time.

Related Articles

What is Online Trading?

Best Oil Stocks to Buy in 2021

But that has changed in recent weeks as expectations for a rapidly improving economy have also raised inflation concerns, possibly denting the attractiveness of equities should yields continue to rise.

Photo Credit: Reuters

The quick rise in rates over the past month has also weighed on richly valued growth names, as interest rates could crimp future earnings. That has weighed on the Nasdaq, which includes mega-cap growth names such as Apple and Alphabet and Microsoft.

(Reporting by Chuck Mikolajczak and Stephen Culp; Editing by Alden Bentley and Cynthia Osterman)