Everything You Need to Know About the Tax Season for 2021

Now that we’re past 2020, 2021 tax season is upon us.

Last year was abysmal for most folks, but we soldier on with life. Paying taxes is a crucial part that continues along with us.

With that said, the government implemented changes to the current tax year. They’ve amended deductions on taxes you owe and added stipulations regarding stimulus checks.

These changes apply to federal taxes, but there could be modifications to your state taxes too. Check your local government for changes in property taxes and other local taxes.

What to Expect

As usual, tax returns must be submitted on April 15.

Also, take note of these other 2021 tax filing dates:

- January 15 – It’s when IRS Free File opens. You could also begin tax preparations with software companies partnered with Free File.

- February 12 – This is the official start of the 2021 tax season. It’s the day the federal government begins accepting and processing individual tax returns.

- February 22 – Expected date for updates to the IRS Where’s My Refund tool. You may encounter more technical difficulties during this time.

- 1st week of March – People may claim Earned Income Tax Credits (EITC) and Additional Child Tax Credits (ACTC). They should have filed electronically and paid via direct deposit, though. Moreover, there should be no issues regarding their tax returns.

- October 15 – Those who requested extensions for their 2020 tax returns must file on this date.

Due to the pandemic shutdowns, people lost jobs and closed their businesses. In response, the government launched several programs intended to help struggling Americans.

People received stimulus checks and gained access to loans. The government postponed debt payments and allowed early withdrawal from retirement funds.

These caused the changes you’ll experience during this tax season. What’s more, you may encounter technical delays in tax filing and processing.

Income Rates and Brackets

Before we discuss recent updates, let’s recall how tax computations work.

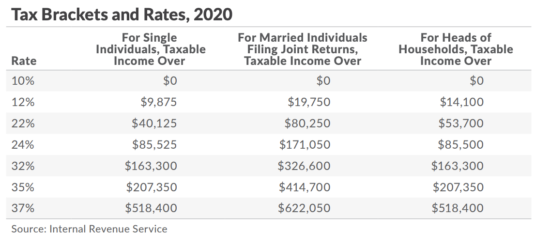

You’re charged taxes based on your taxable income. What’s more, your tax rate will depend on your filing status:

Your taxable income will be computed for every tax bracket you reach. Let’s say you’re a single individual who earns $10,000 annually.

Since your $10,000 exceeds $9,875, you’ll be charged 10% of $9,875 or $987.50. There’s $125 left, so you’ll have to pay 12% or $15.

In total, your taxable earnings for the tax season are worth $135 in this example.

Afterward, it would help if you chose how much you’ll owe based on your deduction method selected.

Tax Credits And Deductions To Consider

Once you’ve computed your taxable income, it’s time to choose your tax deductions.

Your taxes can be derived from either standard deductions or itemized deductions. You’re allowed to change the deduction type every year.

One of them could charge fewer taxes, depending on your financial situation. Analyze your current finances, so you can determine which deduction type best suits your needs.

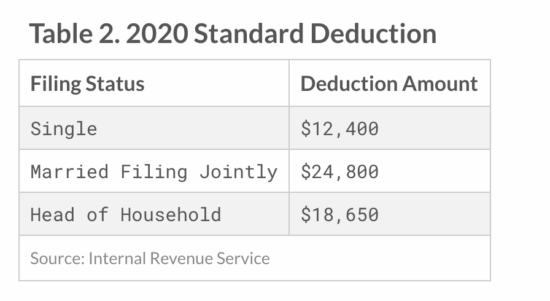

Standard deductions are fixed deductions on your taxable income. Subtract your corresponding deduction amount to your taxable earnings. The difference will be the amount you’ll pay for this tax season:

Most people choose standard deduction due to its simplicity. However, this option is unavailable if you fall under certain criteria.

On the other hand, you’ll have to include valid factors for itemized deductions manually. This makes it a more tedious process than the standard deduction.

You may reduce your taxes further with this method, though. Some assets and emergencies could make itemized deductions a more favorable alternative.

Charitable Deductions

Your act of kindness could lower your payment this tax season.

The CARES Act temporarily suspended limits for charitable contributions. Consequently, you might reduce your taxes further by using standard or itemized deductions.

If you’ve donated cash to qualifying organizations, you could subtract up to $300 of your contributions from taxes. In contrast, you could deduct up to 100% of your adjusted gross income based on donations.

Business Deductions

If you’re self-employed, you may have been able to work from home. Even better, you have access to exclusive deductions this tax season.

You could write off your business expenses accumulated by working from home. You could deduct the amount you’ve spent on your house, vehicle, and other work-related assets.

Unfortunately, you can’t claim these deductions if you’re a regular employee. These are only available for self-employed individuals. you can try Taxfyle’s calculator as additional resources.

Health or Medical Deductions

You could also deduct this year’s medical bills from your tax season payment.

Specifically, you may deduct medical expenses that go beyond 7.5% of your adjusted gross income (AGI).

What’s more, self-employed folks may also be eligible for Self-employed Health Insurance Deduction. It also applies to their children below 27-years-old even if the offspring isn’t a dependent.

Earned Income Tax Credit

There’s another tax deduction method specifically for low to moderate-income earners.

They could request for Earned Income Tax Credit (EITC) this tax season. It’s a viable option this tax season, whether they have children or not.

Furthermore, it has specific rules for members of the military and clergy. People suffering from disabilities and presidentially declared disasters also follow separate guidelines.

For more information, please check the IRS webpage regarding Earned Income Tax Credit.

Child Tax Credit

If you’ve got kids during this tax season, you could apply for certain tax deductions.

You could claim Child Tax Credits (CTC) worth $2,000 for each kid below 17-years-old. You may see that if they exceed the taxes you owe, you could receive a $1,400 known as the additional child tax credit (ACTC).

If you’re a single parent, this tax deduction is reduced by 5% of your adjusted gross income above $200,000. On the possibility of if you’re married, it’s $400,000 instead of $200,000.

The ACTC or refundable CTC is capped at 15% of earnings above $2,500.

How COVID Affects Your Taxes

The government issued lockdowns to safeguard public health against the novel coronavirus.

Unfortunately, this caused millions of Americans to lose their livelihoods. Now, they need help in acquiring basic needs like food and shelter.

In response, the government issued stimulus checks and loans. More importantly, these assistance programs will affect the current tax season. As we’ve shown, standard deductions are slightly higher than last year. The government added $200 to the 2020 standard deductions so that they could adjust for inflation.

Some folks may have been lucky enough to find side gigs during the pandemic. However, they must pay taxes on those odd jobs as well.

If you received unemployment benefits, you’d also have to pay taxes on them. The government considers them as taxable income.

Still, your stimulus check will remain untouched this tax season. It’s treated as a refundable tax credit for 2020.

Retirement Plans

Section 2202 of the CARES Act also allowed people to withdraw from their IRAs.

Consequently, people could tap into their retirement plans during this tax season. They may take out $100,000 from their retirement funds.

However, they must pay the funds back within three years. Alternatively, you could repay it on the year of distribution.

Worse, it could jeopardize your future retirement plans. Please exhaust all possible options before tapping into your future funds.

When will the IRS Accept 2021 Tax Returns?

Again, tax returns for 2021 must be submitted on April 15.

Please check for possible deductions to your taxes. Also, government systems could be overwhelmed this tax season so that you may encounter technical difficulties.

If you can, file your taxes electronically and deposit your payments directly for less inconvenience.

Summary

Due to the COVID-19 pandemic, expect some changes during this tax season.

People are struggling to pay taxes after they’ve lost their livelihoods to the shutdowns. Still, the government launched assistance programs and tax credits to help with tax payment.

Check government websites for additional tax deductions that weren’t discussed. For example, you could check how mortgage interest could reduce income taxes. Moreover, check how your state charges sales taxes, property taxes, and other fees. Local governments can enact their specific tax laws, so understand the ones your state follows.

Nevertheless, your obligation to pay during tax season remains unchanged.

If you need more financial tips, click here.