How to Budget Your Money?

Regardless of what you are going through, having enough control over your finances can help you govern where exactly your money is going as you pave your way to financial freedom.

It isn’t hard to budget your income. With a few brutal lifestyle changes with regard to how you spend your cash, you can save money and enjoy some freedom. In some cases, your cash might be getting lost through irrelevant ways, meaning that you can save some more without affecting too much of your lifestyle.

Here are a few money-saving tips to consider using to improve your budget:

How to Budget Your Money: Review Your Bills

While it might not feel like much, your shopping and grocery bills can take up a good part of your budget. You will be amazed by the annual cost of taking a single cup of coffee at your local restaurant. Understanding the different outlets for your funds, including meal expenses, is the first step to the best way to save money.

To cut down this cost, try eating from your home less instead of eating out. Although eating out is a great way to meet up with friends, it can increase your expenses. On the flip side, preparing your own meals can not only reduce your meal budget but also be a healthy option. It allows you to choose the ingredients you can add to your food, unlike eating out where these ingredients are chosen for you.

Want to cut back on sodium? This is among the best ways to do it. However, if you have been eating from your home but still feel like your meal budget is too high, consider cooking from scratch instead of using convenience foods. Also, buy your ingredients in bulk as these are cheaper purchases. Lastly, create a meal plan to ensure that you can be in control of your financial situation week by week.

How to Budget Your Money: Make Cash Purchases

Your debit and credit card can provide some convenience in that you do not have to carry cash around when shopping. The only bad thing is that it is tougher to track your expenses when using them. In this case, you might end up getting into too much debt if you always use your credit card for expenses.

Instead, switch to making purchases with the money in your pocket. This will place a glass ceiling on what you can spend at a single go, reducing the chances that you will buy something out of impulse.

Look For Ways to Reduce Your Insurance Premium Amounts

While insurance is a great way to protect yourself from any future risks, it doesn’t have to be that expensive. With a few tweaks, you can enjoy the affordable car and life insurance rates, and free up some extra cash. For instance, work on improving your credit score since insurance companies view people with a great credit score as responsible clients, earning them an affordable insurance premium.

As for reducing your car insurance costs, you can consider buying a car that has enough safety features. It might also pay to take advantage of low mileage discounts. Lastly, be sure to request for a higher deductible from your car insurance company to lower the costs.

Open a Savings Account

If you do not track your expenses, it can be pretty easy to spend your salary, only to realize that you haven’t paid recurring expenses like your utility bill. With a checking account, it becomes easy to automate these tasks. It also reduces the tendency of having to borrow funds elsewhere to offset this balance or even miss making essential payments.

However, if your goal is to save, be sure to place the bulk of your cash in a savings account since they do command a higher interest rate than checking accounts. In fact, you can connect your savings account to your checking account to automate the process. It might pay to commit to sending a specific percentage of your income to the savings account to help you start saving for a rainy day.

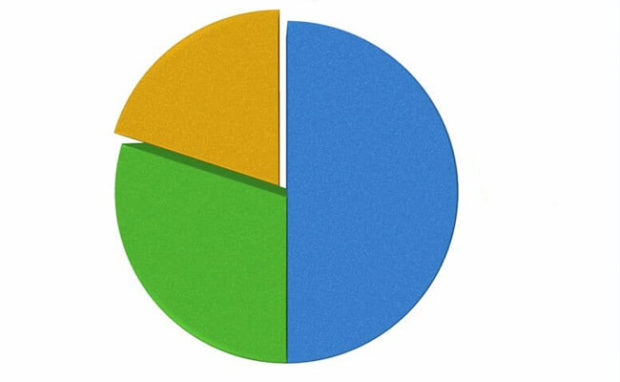

Use the 50-30-20 Budgeting Rule

If you realize that you need to revamp your saving goals but don’t know how to save money fast, then the 50-30-20 budgeting rule can help you out. Under the rule, you should spend 50% of your earnings on your needs. These are bills that need to be paid every single month, including rent, loans, shopping for meals at grocery stores, insurance, and even cell phone and cable bill.

With this out of the way, you can then allocate 30% of your income to your wants. These are the simple things that you want but aren’t a necessity. For instance, shopping for an expensive dress or making plans to spend time in luxurious vacation locations aren’t a necessity. Lastly, you should channel the remaining 20% into savings. In case the 50% you allocate to your ‘needs’ column isn’t enough, consider taking a bit from your ‘wants’ to fill the deficit.

How to Budget Your Money: Prioritize Paying Off Debts

If you typically use credit cards, you might be surprised at the amount you spend each month to pay off the interest on the loans. In case you pay off all your credit card debt, it can help free up a good part of your income. Focus on paying down this and other debts you might have.

Be careful with any other debt that you take on. For instance, while payday loans might be inviting, they do require paying a high-interest rate to use them, and the chances of getting into a debt trap are pretty high. Consider factors like interest rates and your current financial situation before taking up loans. If you have the option to wait until your paycheck arrives, prioritize it.

Take Advantage of Deals That Will Save You Money

Nowadays, businesses use coupons and inviting deals to earn customer loyalty. Why not use such a deal to your advantage? For instance, you can shop for an item when the goods are on sale. Consider also leveraging coupons and online deals to save a few dollars.

However, this will only work for you if you actually need the deal. It makes little sense to buy two microwaves just because there was an offer for buying two and getting one free. Do the math and try to figure out if such deals are working in your favor. Also, consider being a member of retail stores that offer deals and discounts to their members. While hunting for such deals might seem to have a minimal impact on your spending habits at first, combining a couple of deals will have a huge impact on your budget.

SUMMARY

Budgeting without a plan for cutting your expenses, in the long run, will constantly leave you with unattained goals by the end of each month.

The sooner you can be in control of how you spend, the easier it will be to execute any long term financial plans you have. It starts with achieving the minor milestones, and you will be saving for retirement before you know it. Consider the tips above to both save lots of money and enjoy some financial freedom.