Best Credit Card Debt Payoff Calculator

A good way to ensure that you stay out of debt on your existing credit cards is to use a credit card debt payoff calculator such as Credit Karma. The site calculates how long it will take to pay down your credit card debt.

You enter information into the provided fields. These are titled “balance owed,” “interest rate,” “expected monthly payment,” and “desired payoff time-frame.” The credit card debt calculator will consider these financial considerations and provide a plan for paying off your debt.

The debt calculator will help make your existing debt more manageable or allow you to plan for future credit card expenses.

Getting to Know Your Credit Score

First, let’s discuss the differences between different credit scores. A credit score can range from around 300 to 850 points. Additionally, a score of 700 and higher is considered a good credit score and will generally allow you to obtain loans without being denied. Getting a high credit score can also help to lower interest rates. An online credit card debt payoff calculator will give you financial recommendations to help you achieve a higher credit score. These suggestions may relate to changes in your credit limitations and other account-relevant variables.

Where To Find Credit Card Debt Payoff Calculators?

You can obtain your credit score from Equifax, TransUnion, and here on Credit Karma. The signup process is quick to complete and will not incur charges against your credit.

Credit Karma also offers a Credit Score Stimulator. This online tool will help determine what would happen if you opened a new credit card. Simultaneously, it tells how large expenses would affect your credit score.

Credit Karma Features:

- Direct Dispute – If you see any errors on your existing credit report, you can dispute them directly through the Credit Karma platform.

- Approval Odds – Credit Karma will estimate the likelihood of approving new loans or credit cards.

- Credit Monitoring – Credit Karma can assist in monitoring your current credit-related status.

- Credit Karma will alert you if any significant changes are made to your credit report; this includes any potential fraudulent activity.

- Credit Karma offers an easy-to-use mobile app to pull reports in real-time.

- Credit Karma will generate recommendations for credit cards or loans that could help save you money compared to your current credit payments.

Refinancing Your Credit Cards

One option to help improve your credit score is to refinance your cards for a lower annual fee. Lowering your total credit spending limit will also help reduce your monthly payments. These financial tactics can help you build your credit score for future business ventures.

Capital One Credit Lines are a great partner of Credit Karma and can provide tools to benefit your credit score. We recommend using the credit card debt payoff calculator to manage or improve your financial situation.

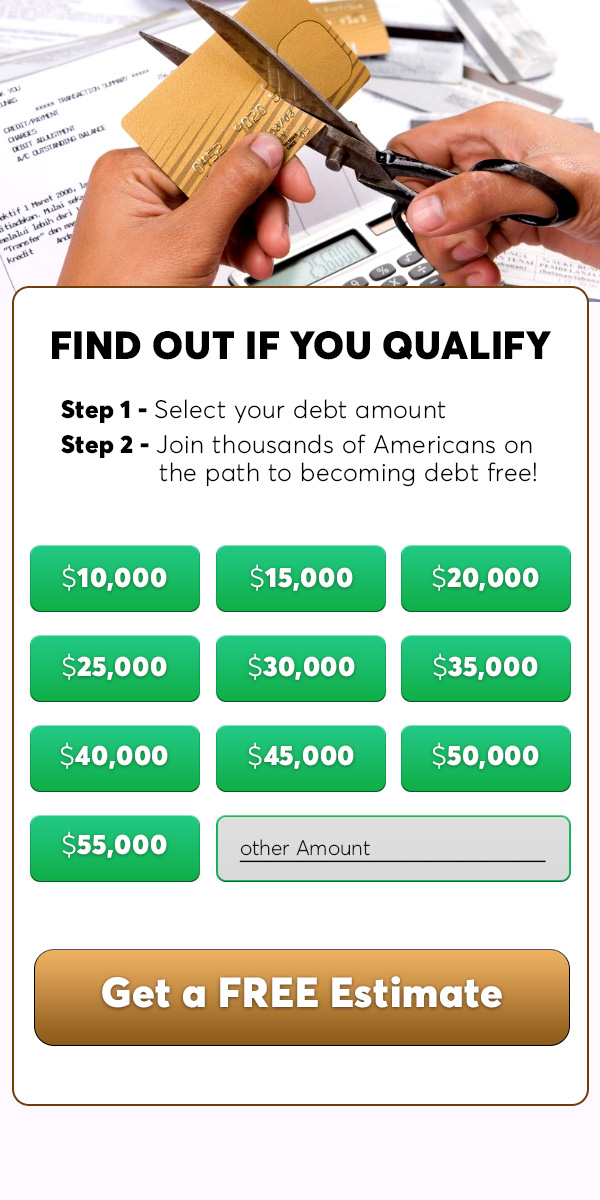

Are you ready for a Quick Quiz?

Take this 60-second quiz to check if you qualify for a credit card payment reduction

How Much Will You Save?

Check if you qualify in two simple steps

- Step 1 – Select your debt amount below to see if you’re eligible

- Step 2 –Answer a few quick questions & join hundreds of thousands of Americans on the path to becoming debt-free

Vantage Score

Many Americans need more scoring consistency for their credit scores. All three credit bureaus have designed a model called “VantageScore” to obtain a more consistent standard of credit scoring across the board. When you use a credit card debt payoff calculator, you’ll see how to get debt better managed and financed.

A VantageScore has three scoring models. They calculate your scores based on the following:

- Your payment history – They will look at the consistency of payments made and look for any late fees in your account. They will look to see how many lines of credit you have open and have had available in the past.

- How long you’ve had credit – They will look at the duration of the lines of credit you currently have open.

- Which types of credit lines do you have – the different types can be anything from home loans, auto loans, student loans, refinances, home improvement loans, etc.

- Current credit limits – The limit of credit on your credit cards is contingent upon several factors, including your credit score.

- The amount of debt – The amounts owed for purchases. This is often called the “debt-to-income” ratio, or how much money you bring in (gross annual income) compared to how much you owe in debt.

- Any hard inquiries on your credit report – This is the act of “pulling” credit when you visit a lender. This is particularly scrutinized when applying for an auto or home loan.

Read more: How to Pay Off Debt: 10 Ways to Kill Debt with a Low Income

Frequently Asked Questions

How Can You Improve Your Credit Health?

Several factors play a crucial role in determining your credit score. One important factor is your payment history, specifically your ability to pay bills on time. Late or missed payments can have a detrimental impact on your credit score. Additionally, it is advisable to avoid closing old credit card accounts, as doing so can significantly lower your credit score. Another important aspect is managing your debts effectively. Keeping your overall credit card utilization below 30% demonstrates responsible credit usage and helps maintain a good credit score. It’s also essential to avoid opening multiple credit cards simultaneously, as having too much available credit can work against your credit score. Finally, diversifying your credit mix is beneficial. Lenders prefer to see a variety of existing credit, such as a combination of credit cards, loans, and mortgages. By considering and implementing these factors, you can positively influence your credit score.

Can a Credit Card Debt Payoff Calculator help me save money?

Absolutely! By utilizing a credit card debt payoff calculator, you can identify potential opportunities to save money. The calculator reveals the impact of making larger payments or paying more frequently on your debt. By increasing your monthly payments or making biweekly payments instead of monthly ones, you can accelerate your debt payoff and significantly reduce the amount of interest paid over time. This strategy can save you money in the long run, allowing you to become debt-free sooner and allocate your funds towards other financial goals.

Is it safe to use an online Credit Card Debt Payoff Calculator?

Yes, it is generally safe to use online Credit Card Debt Payoff Calculators. Reputable financial websites and tools take user privacy and security seriously, employing encryption protocols to protect your personal and financial information. However, it’s essential to exercise caution when providing sensitive details. Ensure that you use trusted calculators from reputable sources and avoid sharing any personally identifiable information unless necessary. It’s always wise to review the website’s privacy policy and ensure that you are comfortable with their data handling practices before using any online tools or calculators.

Published on February 16, 2019; Updated on June 18, 2019; Updated on June 27, 2023.