How to Get Rid of Student Loan Debt? Strategies to Financial Freedom

A lot of new graduates are thinking about how to get rid of student loan debt. For some, this can be a daunting task, but with the right strategies, it is achievable.

This article will guide you through effective strategies to get rid of your student loan debt. You can pave the way toward a debt-free future by understanding options like loan forgiveness programs, income-driven repayment plans, refinancing, and maintaining a good credit score.

Ready For a Quick Quiz?

What Are The Quickest Way to Get Rid Of Debt?

The quickest way to get rid of student loan debt depends on your circumstances and the type of loans you have. Here are a few strategies that may help expedite the repayment process:

The Debt Avalanche Method To Pay For Student Debt

The debt avalanche method is one of the smart ways to get rid of student loan debt. Also known as the accelerated debt repayment plan, it places debts with high-interest rates over the smaller ones. In this method, the debtor must allocate funds to settle the minimum payment on individual debts. Then, they dedicate the remaining debt-repayment money to the debt with the maximum interest rate.

Once you pay off the current debt with the maximum interest rate, you proceed to pay off the second highest debt with the debt avalanche method. This process continues until you have fully paid off all debts.

To make the debt avalanche method effective, the debtor must allocate a portion of their income that is not being used towards paying off debt. This fund doesn’t include the necessary living expenses, like groceries, rent, daycare, or transportation fees.

Example of Debt Avalanche Strategy

Below is a hypothetical case of how debtors can pay off debt through a debt avalanche method.

Let’s say Alex has $500 extra funds per month after settling his essential needs. And his current loans are;

- $1,000 on a credit card debt with a yearly interest rate of 20%

- $1,550 monthly car payment at a 10% interest rate

- $5,200 line of credit (LOC), with a 7% interest rate

If each debt has a minimum monthly payment of fifty bucks ($50), Alex would have to designate $100 to the second and third debts. In turn, he is devoting the remaining $400 to the first loan with a 20% interest rate, which appears to be the highest.

With consistency, Alex would pay off the first loan at the end of the fourth month, he pays 450 bucks each month. After completing the payment for the first debt, the debtor needs to proceed to the second-highest debt, which corresponds to the second loan in the list.

Note: Opposite to what many bloggers portray, the order of preference of the debt avalanche method isn’t about the amount of debt, but the percentage of the interest rate.

To read more about the debt avalanche method and its benefits, check out this guide.

Disciplining Yourself Financially or Contacting a Debt Manager

If you’ve got enough money in the first place, you won’t be indebted to the bank. Though it’s a painful process, taking responsibility is the first leap toward financial discipline.

Most federal student loans qualify for a standard repayment plan. As a result, payment spreads over a 10-year duration. Likewise, if an average student debt of $37,000 and 5% is divided through 10 years, the monthly payment would be $392 for 10 years.

For those who can’t afford a standard repayment loan due to their responsibilities or lifestyle, there are two other repayment plans you could opt in for, namely;

- Extended payment program: The duration for an extended payment program is 25 years. Though it makes your monthly payment lesser, you’d pay more interest in the long run.

- Graduate Repayment Program: The duration is still 10 years, but the initial monthly payments are lower and it gets bigger over time. This program works for those, whose salaries increase with time. The monthly payments are projected to increase by 20% every two years on a bi-annual basis. The highest payment you’d ever make throughout the program won’t be more than three times the initial payment.

Note: repayment plans don’t cancel your debts. The best you could get from these programs is a manageable extension, which is fair enough for people who are not in a haste to pay off their debts.

You May Also Like: US cancels 40,000 student loans, provides help to 3.6 million more

Seek a Loan Forgiveness Program

United States citizens, who opted for federal college loans are eligible for student loan debt relief forgiveness plans. There is four student loan debt forgiveness and in addition, there is a student loan debt relief plan for each state.

As a matter of fact, these plans are designed to forgive your debts after 20 years of public service. This is suitable for individuals with substantial amounts of debt. To qualify for this program, you must have paid parts of your debts.

Related Articles

Just Graduated? 10 Tips to Pay Off Student Loans Fast

Student loan pause – what financial tips to do

Below Is the Four Federal Student Loan Forgiveness:

- Public Service Loan Forgiveness: This program pardons the loan balance of qualified applicants after making 120 qualifying payments. Certainly, the good news is that PSLF disbursements are tax-free. PSLF was created under the College Cost Reduction and Access Act of 2007, in a bid to help qualified public workers pay off their debts. To qualify for this loan forgiveness program, you must be willing to work for the federal government for a specified amount of time.

- Teacher Loan Forgiveness: Are you a public elementary school or high school teacher struggling to pay your loans? If yes, then, TLF is one of the best student loan forgiveness for you. It’s worth mentioning that only teachers who took out loans after Oct 1, 1998, are eligible for this offer.

- Perkins Loan Cancellation: Perkins loan cancellation helps eligible nurses pay off their loans faster. To qualify, you must be a public worker and be willing to work in a high-need area.

- Nurse Corps Loan Repayment Program: Nurse Corps LRP settles about 85% of the remaining student loan of eligible nurses. Compared to Perkins loan cancellation, it’s quite competitive.

Income-Driven Repayment Programs With Forgiveness

Borrowers who took out loans since 2009 qualify for income-based repayment. This is the most available income-driven repayment and student loan consolidation plan for federal workers. With payment caps sustained on income, you can pay $0, if your income is that small. Then, after 20-25 years depending on the criteria, your balance would be pardoned.

These are the income-driven repayment plans available in the US:

- Income-Based Repayment: This plan is only applicable to loans taken out after July 1, 2007. With this, you’re expected to devote 10% of your discretionary income and your outstanding balance would be pardoned after 20 years.

- Pay As You Earn: PAYE is only applicable to loans taken out after Oct 1, 2007, and disbursed after Oct 1, 2011. Like income-based repayment, you’re required to set aside 10% of your discretionary income for 20 years before it’s forgiven.

- Revised Pay As You Earn: unlike the first two income-driven repayment plans we discussed, REPAY has no payment caps and your payment could be larger if you earn more. You’re expected to set aside 10% of your discretionary wage and your outstanding balance would be pardoned after 20 years.

- Income Contingent Repayment: ICR gives you an option: you either pay 20% of your discretionary income or pay a fixed amount for 12 years.

You May Also Like: Biden’s student-loan forgiveness on $125k income limit is unfair for Americans

Ask Your Employer About Student Debt Repayment Programs

Some private companies or employers may offer their workers student loan disbursement, to get them to stay in the company for a specified duration. Though the concept is kinda new, it’s becoming famous in the corporate world. Make inquiries from your HR department, if your company provides disbursement.

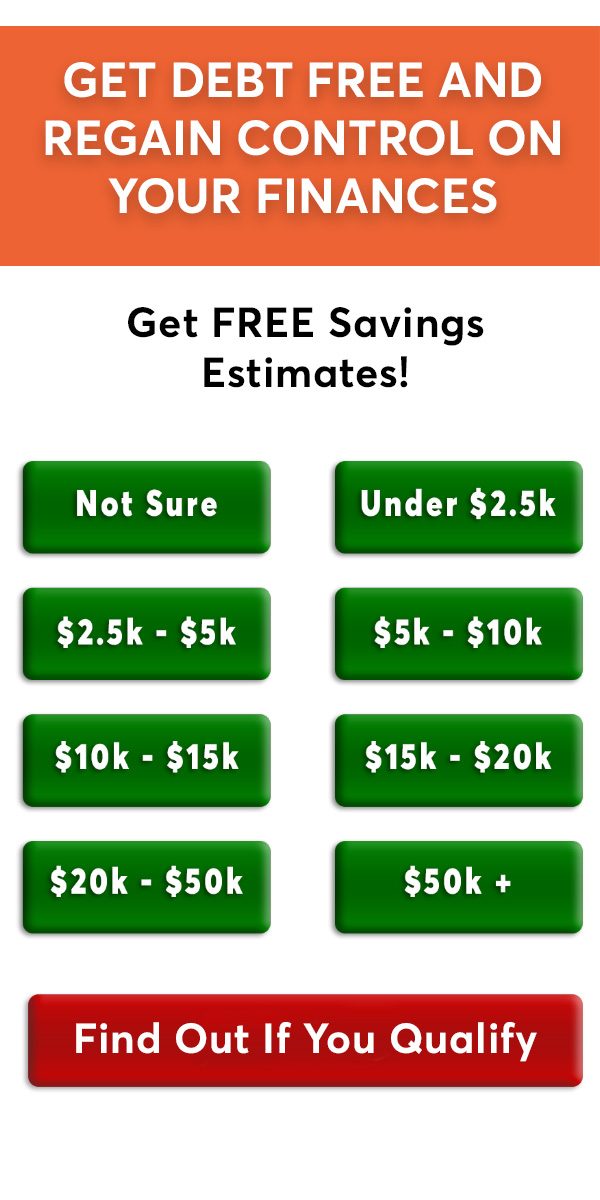

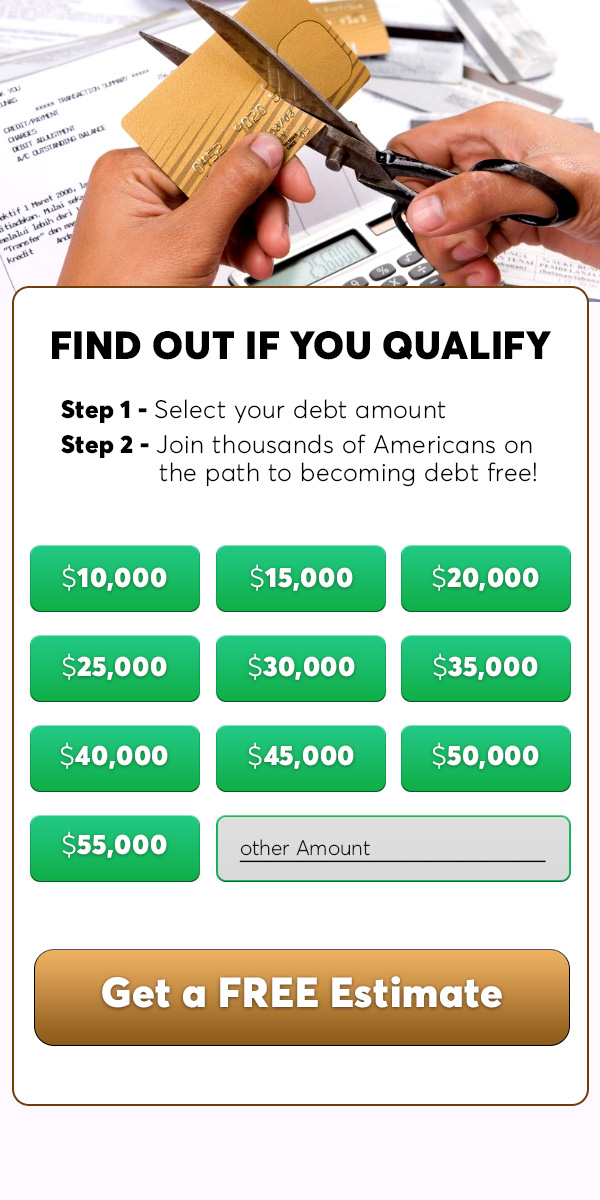

How Much Will You Save? Check if you qualify in two simple steps

- Step 1 – Select your debt amount below to see if you’re eligible

- Step 2 –Answer a few quick questions & join hundreds of thousands of Americans on the path to becoming debt-free

You May Also Like: Student Loan Forgiveness Programs

Conclusion

In conclusion, tackling how to get rid of student loan debt requires careful consideration of various strategies. Exploring options like PSLF, income-driven repayment plans, loan forgiveness programs, refinancing, and maintaining a good credit score can pave the way toward a debt-free future. It’s important to stay informed and seek guidance from the Department of Education or a reputable financial advisor to determine the best course of action based on individual circumstances.

Though these methods require high discipline and commitment, you can also consolidate your federal loans with the help of a student loan forgiveness program.

Frequently Asked Questions

Why Does The Avalanche Method Work?

The debt avalanche method shields the debtor from paying excessive compound interest, which increases with time.

Most lenders use compound interest rates, which increase the interest on your debt over time. Compound interest is the summing up of interest to a bulk deposit or loan, which is a consequence of keeping interest for a long period instead of paying it off. The interest banks earn is the sum of the principal sum and accumulated interest.

The rate of increase depends on the frequency of compounding and the duration. The higher the duration, the higher the interest. A good percentage of credit card balances compound daily while others compound monthly, semi-annually, or annually.

The only downside of the debt avalanche method is that it requires discipline and devotion to make it work. People easily settle for the required minimum payment on all debts due to their lifestyle, unforeseen expenses, or home, even repairs. That’s the reason we advise people to save up at least six-month emergency funds before applying the debt avalanche method.

You May Also Like: Could Student Debt Eventually Be a Thing of the Past?

How Do I Calculate the Compound Interest on My Loan?

You can calculate the compound interest on your loan using the formula A = P (1 + r/n) (NT), by inserting the starting principal value (P), yearly interest rate (r as a decimal), time factor (t), and the number of compound durations (n). To derive the figure of the compound interest only, deduct the principal (P) from the result gotten from the equation.

It’s worth mentioning that the formula above provides you with the future amount of the loan, which is the addition of the principal (P) and the compound interest.

The formula for compound interest and the principal sum is:

- A = P (1 + r/n) (NT)

- For compounded interest-only = P (1 + r/n) (nt) – P

Where:

- A = the potential value of the loan, including interest

- P = the principal loan amount

- r = the yearly interest rate (in decimal)

- n = the no of times the interest was compounded per unit t

- t = the duration the debt was incurred.

Let’s take a look at a hypothetical case study.

Assuming $5,000 was deposited into a savings account with a yearly interest rate of 5%, which is compounded per month, the amount of the investment after a 10-year period is…

- P = 5000.

- r = 5/100 = 0.05 (decimal).

- n = 12.

- t = 10.

If we insert those figures into our formula, the following values show up:

- A = 5000 (1 + 0.05 / 12) (12 * 10) = 8235.05.

So, we get a total value of $8,235.05 after 10 years.

Can student loan debt be canceled?

Yes, student loan debt can be canceled or forgiven under certain circumstances. Various forgiveness programs are available, particularly for borrowers with federal student loans.

It’s important to note that each forgiveness program’s eligibility requirements and conditions vary. It is recommended to research and understand the specific criteria for the forgiveness programs offered by the Department of Education. You need to consult with loan servicers or financial advisors to determine if you qualify for loan cancellation based on your circumstances.

However, it’s crucial to differentiate loan cancellation or forgiveness from loan discharge, which occurs in cases such as total and permanent disability, closure of the school, or in rare instances of fraud or misrepresentation by the school.

Remember to stay informed about the latest updates and requirements regarding student loan cancellation or forgiveness programs to make informed decisions regarding student loan debt.

What happens when you have student debt?

When you have student debt, it means that you owe money for the educational expenses you incurred while pursuing higher education. This debt typically includes the borrowed funds plus any accrued interest. If you have student debt, you must repay the agreed loan by the lender. You must make regular monthly payments, starting a few months after graduating, leaving school, or dropping below half-time enrollment.

Failure to make payments can result in penalties, increased interest, damage to your credit score, and potential legal consequences. Managing your student debt responsibly and exploring repayment options is crucial to ensure timely repayment and minimize the financial burden.

How do I stop accruing interest on my student loans?

To stop accruing interest on your student loans, you have a few options. First, if you have subsidized federal student loans, the government pays the interest while in school and during certain deferments or grace periods.

This means you won’t accrue interest during those periods. Second, you can make interest-only payments or pay more than the minimum monthly amount, which reduces the principal balance and, consequently, the interest that accrues. Additionally, you may qualify for deferment or forbearance if you have federal loans, which temporarily pauses or reduces your loan payments.

Finally, refinancing your loans with a private lender may allow you to secure a lower interest rate, potentially reducing the interest you accrue. Remember to carefully consider the implications of each option and explore the best solution for your specific circumstances.

Published on May 31, 2019; Updated on June 15, 2023.

Sponsored Advertising Content:

Advertorial or Sponsorship User published Content does not represent the views of the Company or any individual associated with the Company, and we do not control this Content. In no event shall you represent or suggest, directly or indirectly, the Company's endorsement of user published Content.

The company does not vouch for the accuracy or credibility of any user published Content on our Website and does not take any responsibility or assume any liability for any actions you may take as a result of reading user published Content on our Website.

Through your use of the Website and Services, you may be exposed to Content that you may find offensive, objectionable, harmful, inaccurate, or deceptive.

By using our Website, you assume all associated risks.This Website contains hyperlinks to other websites controlled by third parties. These links are provided solely as a convenience to you and do not imply endorsement by the Company of, or any affiliation with, or endorsement by, the owner of the linked website.

Company is not responsible for the contents or use of any linked website, or any consequence of making the link.

This content is provided by New Start Advantage LLC through a licensed media partnership with Inquirer.net. Inquirer.net does not endorse or verify partner content. All information is for educational purposes only and does not constitute financial advice. Offers and terms may change without notice.