Do VA Home Loans Require a Minimum Credit Score?

The Department of Veteran Affairs does not set a minimum credit requirement for a VA home loan. Lenders who fund loans can establish credit requirements.

A VA home loan helps U.S. veterans and their spouses become homeowners, without having to make a down payment and regardless of having less than ideal credit scores. Lenders all over the country offer these loans, which the United States Department of Veterans Affairs (VA) insures. Aside from having no obligation to make a down payment, these are other significant benefits of a VA mortgage:

- Easier eligibility requirements compared to a traditional loan

- No mortgage insurance

- Minimal closing costs and interests rates

- Accepts debt-to-income (DTI) ratios above 36 percent

No Minimum Credit Score Required

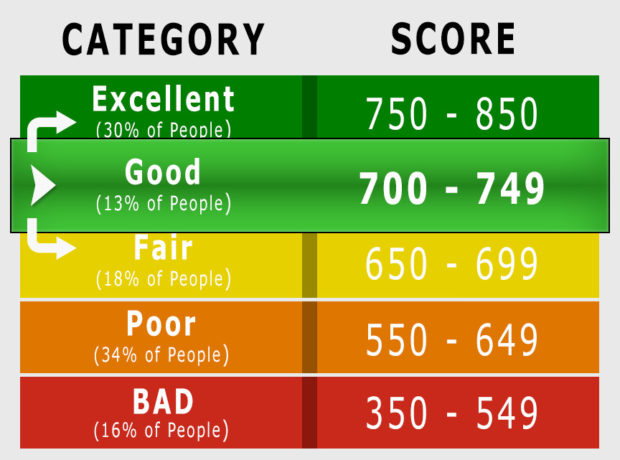

VA home loans are insured by the VA. They do not need veterans to have any particular credit score. However, the loans offered by private lenders may have the requirement for a minimum score, which usually ranges from 580 to 620. Veterans need to be eligible for credit. That is determined when lenders analyze their credit profile. Typically, lenders pull reports from the three primary agencies for credit-reporting: TransUnion, Experian, and Equifax. For qualification, the median or middle rating gets used as your credit score.

Since the VA is not funding the loan, it is the lender who sets a specific benchmark for the credit score. Not all vendors use the same parameter, but reports indicate the average credit score requirement is a FICO score of 620.

Credit scores aren’t the only things checked within the qualifying credit profile. Also, your past patterns with credit get used in the establishment of your repay willingness. If for at least 12 months, a veteran has made payments on time, he or she shows a readiness to repay any credit obligations to come.

Contrarily, a borrowing veteran who has a history of making payments late, delinquent accounts, or judgments, lenders may not consider him or her a satisfactory applicant to receive a loan.

Good Credit Means Better Mortgage Rates Today

While having a low credit score does not completely disqualify you from getting a VA home loan, having a higher score is helpful. You can get better loan terms and better mortgage rates today than you would with less than fair credit. It is at the discretion of the lender to decide the percentage offered to each borrower. In general, those individuals with excellent credit get offered the best rates. However, many homeowners and homebuyers are taking advantage of the current mortgage rates trend which shows the rates decreasing.

Other Factors Affecting Approval of VA Loans

There are other financial considerations that lenders look at to help them determine if you can repay a VA home loan. They consider various factors, such as current income and employment record. Additionally, there are veteran requirements that need to be met, like the character of service, duty status, and length of service. Having a VA Certificate of Eligibility (COE) is an essential component of your loan application. To qualify for a VA loan, you must meet at least one of these conditions:

- You are the spouse of a service member who is no longer alive because of a service-related disability or who died in active duty.

- During wartime, you have served in active service for 90 consecutive days.

- You have over six years of Reserves or National Guard service.

- During peacetime, you have served in active service for 181 days.

There are six items which could negatively affect your ability to obtain a VA loan and impact your credit profile:

Foreclosure

A person would generally not be eligible to receive a VA loan if the following events happened. If a borrower’s past residence or real property got foreclosed on. Or you were given a deed-in-lieu of foreclosure in the last two years after the date of disposition. FHA loan defaults can lead to waiting for three years for a VA loan. If it was a VA loan foreclosure, full entitlement of a new mortgage might not be available.

Late Payments on Mortgage

In cases unrelated to bankruptcy, a Veteran or spouse can undergo re-establishment of satisfactory credit if, for 12 months after the derogatory credit term, adequate payments were made. Having more than one 30-day late payment may be acceptable by some lenders. The policies regarding late payments are different for each vendor. If the court has made a judgment on account balances, it is subject to a payment plan offering a timely repayment schedule. Judgment policies can vary from lender to lender

Federal Debts and Collections

Derogatory and collection debt may be allowable within a window of time as offered by the specific lender. Payments need to be currently in progress, otherwise, the lenders may put a halt on the VA loan until further contributions are made.

Chapter 7 Bankruptcy

According to VA guidelines, at least two years must pass by after the date of discharge for the borrower or spouse’s Chapter Seven bankruptcy. However, it is not based on the date that it was filed. The borrower would need to provide a detailed explanation of the bankruptcy. Also, he or she must have a stable income to be eligible for the financial assistance

Related Articles

Best Mortgage Rates: Wells Fargo Home Loans

5 Steps on How to Qualify for a Home Loan

Best VA Mortgage Rates Today

Chapter 13 Bankruptcy

Under the VA guidelines, a borrower is still paying on a Chapter 13 bankruptcy if it’s verifiable that satisfactory payments were made to the court for one year. To proceed, the court trustee must provide written approval to do so. There needs to be a complete explanation of the bankruptcy, and the borrower must have secure employment, have re-established good credit, and have qualification financially.

No Credit to Report

Lenders do not find a lack of established credit history favorable. If a borrower has only one credit score, it must meet the lender’s in-house benchmark for it to be considered permissible. Without a credit score, borrowers will have to spend a lot of time building a credit profile before achieving the requirements to receive a VA home loan. Specific lender terms are subject to different conditions, so be sure to research the specifics of your consultant when inquiring about a VA home loan.

Additional Resources

How Can Your Debt Equity Ratio Impact Your Overall Finances?

How to Get out of Debt With the Debt Snowball Method