Advertorial or Sponsorship User published Content does not represent the views of the Company or any individual associated with the Company, and we do not control this Content. In no event shall you represent or suggest, directly or indirectly, the Company's endorsement of user published Content.

The company does not vouch for the accuracy or credibility of any user published Content on our Website and does not take any responsibility or assume any liability for any actions you may take as a result of reading user published Content on our Website.

Through your use of the Website and Services, you may be exposed to Content that you may find offensive, objectionable, harmful, inaccurate, or deceptive.

By using our Website, you assume all associated risks.This Website contains hyperlinks to other websites controlled by third parties. These links are provided solely as a convenience to you and do not imply endorsement by the Company of, or any affiliation with, or endorsement by, the owner of the linked website.

Company is not responsible for the contents or use of any linked website, or any consequence of making the link.

Silverlake Financial Reviews and Ratings

SilverLake Financial Company Logo

Is that “pre-approved loan” mailer too good to be true? Facing debt can be stressful, especially when high-interest balances pile up and you’re offered what looks like an easy way out.

Many borrowers report that SilverLake Financial’s mailers advertise low-rate loans, but lead instead to debt settlement programs with very different terms.

If you’re wondering whether SilverLake Financial is a trustworthy option or just another reroute, you’re not alone.

This review breaks down the company’s services, fees, customer experiences, and who their programs are really best suited for.

What is Silverlake Financial?

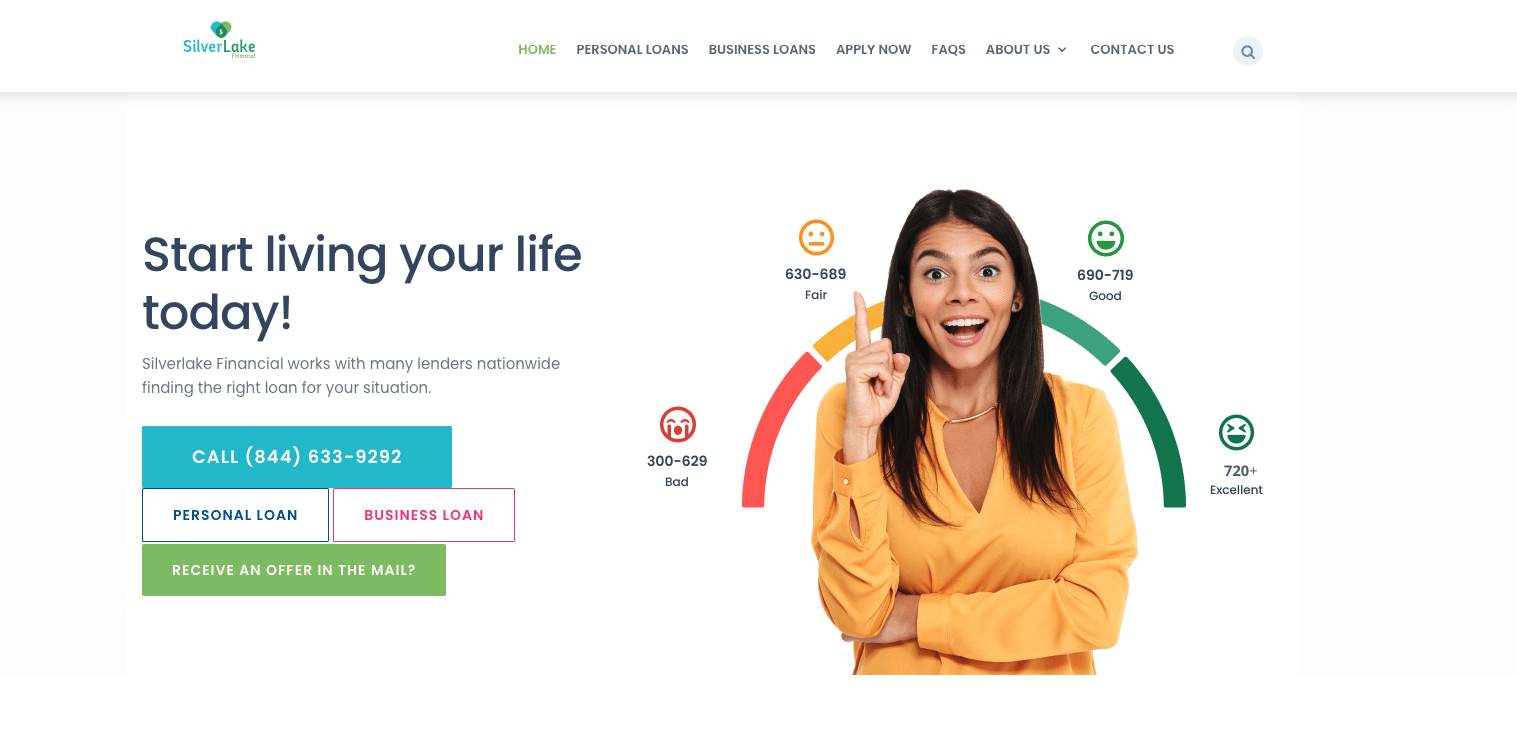

SilverLake Financial Website Homepage

Founded in 2015 and headquartered in Newport Beach, California, SilverLake Financial LLC is a financial services company that connects borrowers to lenders and third-party debt settlement providers. The company markets heavily through pre-qualification mailers offering personal loans with interest rates as low as 5.95 percent.

SilverLake Financial is accredited by the Better Business Bureau (BBB) with an A+ rating but is not a member of the American Association for Debt Resolution (AADR) or the International Association of Professional Debt Arbitrators (IAPDA). While they advertise debt consolidation loans, some borrowers are instead routed into debt settlement programs — a process that can significantly impact credit scores and financial outcomes if misunderstood.

What services does SilverLake Financial offer?

SilverLake acts primarily as a broker, offering two types of debt solutions: personal loans and debt settlement programs.

- Loan amounts range from $5,000 to $100,000

- Interest rates start at 5.49 percent and can reach up to 29.99 percent for lower credit scores

- Loan terms typically span two to seven years

- Applications begin with a soft credit pull

- Approval depends on credit history, income and debt load

- These are not loans — they involve negotiating with creditors to reduce the total balance owed

- Available only for unsecured debts, such as credit card debt, medical bills, and personal loans

- Typically offered to borrowers with at least $20,000 in total unsecured debt

- Fees typically range from 15 to 25 percent of enrolled debt

- Settlement services are handled by third-party providers

How much does SilverLake Financial charge?

SilverLake Financial’s fees depend on whether you’re approved for a personal loan or enrolled in a debt settlement program.

Loan products:

- May include an origination fee, typically between 1 and 5 percent, depending on the lender

Debt settlement programs:

- Fees typically range from 15 to 25 percent of total enrolled debt

- No monthly consultancy fees are charged

- Repayment terms generally range from 24 to 48 months, depending on your creditors

Note: Always confirm whether you are receiving a loan or a settlement offer — the distinction significantly affects your credit score and overall cost.

SilverLake Financial customer reviews and complaints

SilverLake Financial’s reviews reflect a mix of positive experiences with knowledgeable reps and concerns about misleading marketing or unclear program terms.

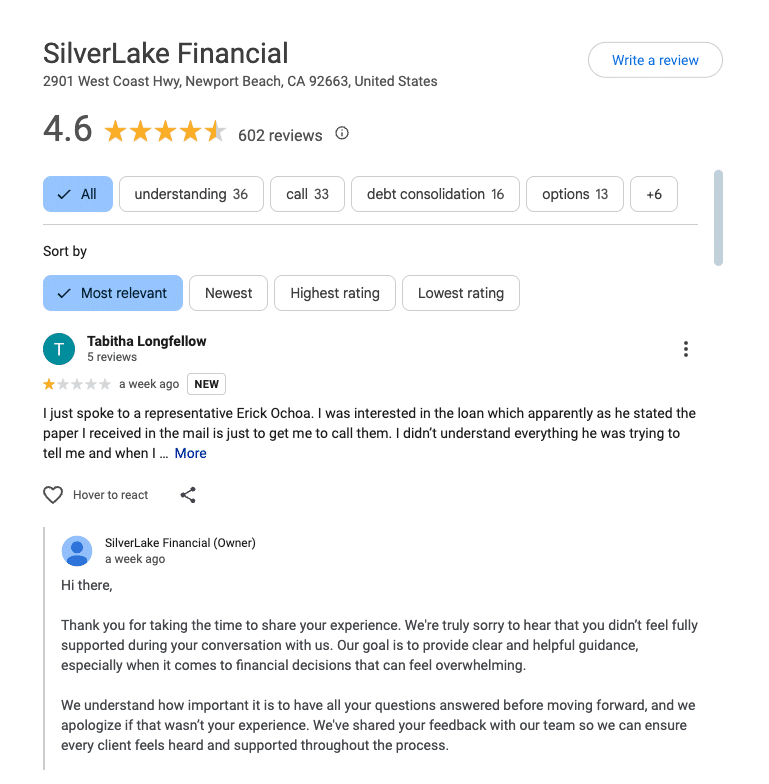

Google reviews

SilverLake Financial Google Reviews Snapshot

- Rating: 4.6 out of 5 stars

- Total reviews: 602

Positive themes:

- Reviewers praise staff like Michelle Belle and Erick Ochoa for being professional, empathetic and clear when explaining debt relief options

- Customers appreciated a smooth application process and flexible repayment plans

Negative reviews:

- Some users report receiving mailers for loans, only to find out they were actually being offered a settlement program

- Several customers say they were referred to outside providers, such as Clarity Debt Resolution, without full explanation

- Complaints include ongoing telemarketing calls even after opting out

Sample review: “Despite a 40-year spotless credit history, they told me I didn’t qualify… now I get tons of spam calls.” – Bruce H.

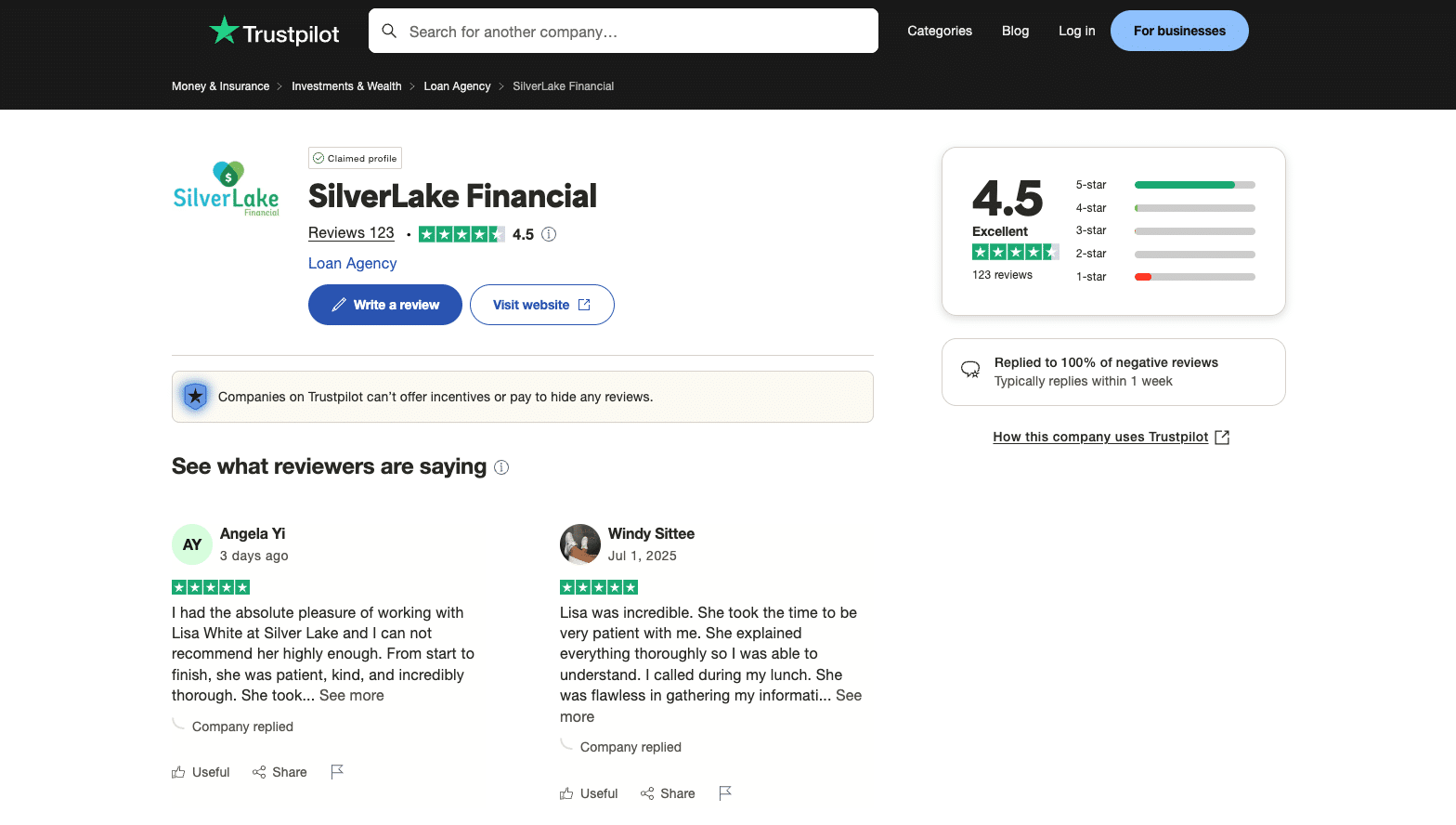

Trustpilot reviews

Trustpilot Reviews for SilverLake Financial

- Rating: 4.5 out of 5 stars

- Total reviews: 123

- Five-star ratings: 83 percent

- One-star ratings: 14 percent

Positive themes:

- Multiple reviews commend Lisa White for her patience, clear communication and compassionate approach

- Customers say the company reduced their financial stress and provided clarity without pressure

Negative themes:

- Some reviewers expected a loan but were offered a settlement program instead

- Reports of hard credit pulls despite assurances of only a soft inquiry

Sample review: “Lisa treated me with care and respect—even when I was inconsistent with replies. She never pressured me and always followed up kindly.” – Angela Yi

Better Business Bureau (BBB) reviews

SilverLake Financial BBB Profile and Customer Rating

- Rating: A+

- Average review score: 4.71 out of 5 stars

- Complaints in the past three years: 11

- Total reviews: 104

Positive themes:

- Clients describe reps as patient and responsive, especially when clients were overwhelmed or anxious

- Follow-up and availability of support were frequently praised

Negative themes:

- Some users reported legal action from creditors despite being in a settlement program

- Others mentioned unclear fee structures and unmet expectations on timeline

Sample review: “They told me my debt would be settled in four months. A year later, nothing happened. I ended up being summoned to court.” – Brandon L.

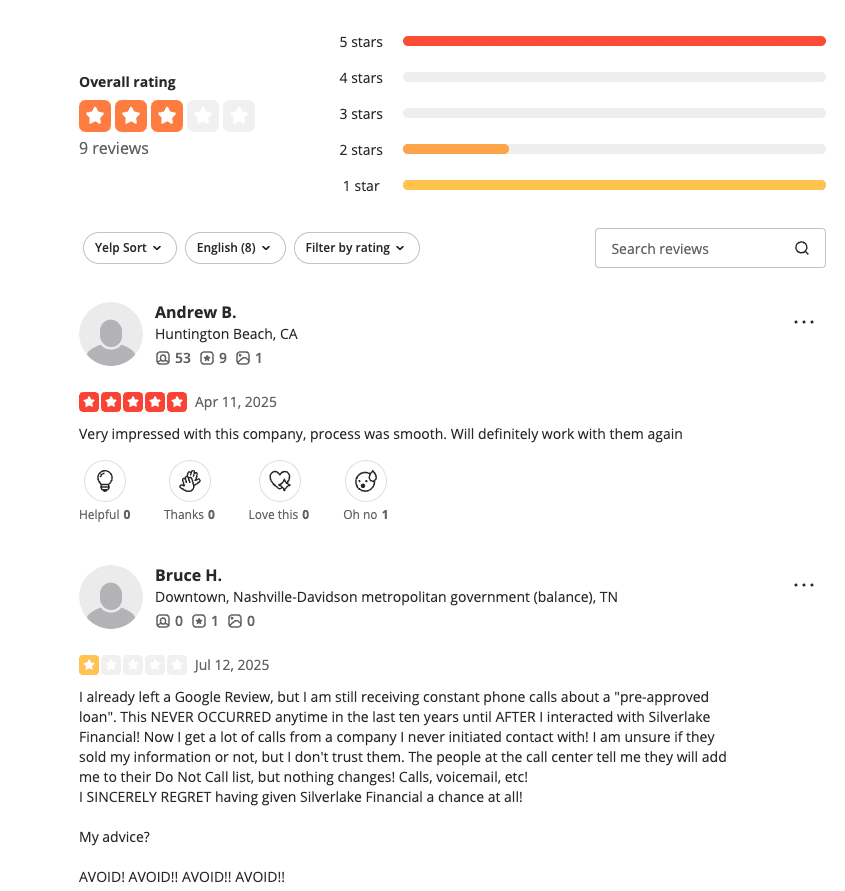

Yelp reviews

SilverLake Financial Yelp Ratings and Customer Feedback

- Rating: 2.9 out of 5 stars

- Total reviews: 9

Positive mentions:

- Several reviews from 2019 praise SilverLake Financial for fast funding, clear interest terms and simple application processes

Negative themes:

- Recent reviewers cite aggressive follow-up calls and confusing communications

- Complaints include being referred to settlement providers without informed consent

Sample review: “After signing with SilverLake Financial, I got transferred to Clarity. They didn’t contact my creditors and the rep insulted me when I asked for updates.” – Eric S.

Reddit reviews

BEWARE of Silverlake Financial! – Putting this post out there, because I didn't a lot of posts about it byu/Troah1 inDebt

- Reddit users caution that reps may use the term “debt modification” to describe debt settlement

- Some users were misled about credit score impacts and the nature of the service

- Others say they were told Clarity Debt Resolution was a government-affiliated program, which was false

Excerpt of review: “The rep said it was a debt modification, not settlement. But the contract said otherwise. I canceled after realizing the misrepresentation.” – u/Troah1

Common concerns:

- Vague language and terminology

- High-pressure tactics

- Lack of transparency in third-party referrals

Pros and cons of SilverLake Financial

Pros:

- A+ BBB rating and responsive to complaints

- Offers both loans and debt settlement options

- May significantly reduce monthly payments

- No monthly service fees for settlement plans

- Soft credit pull advertised during prequalification

Cons:

- Some applicants receive settlement offers instead of loans

- High APRs (up to 29.99 percent) for subprime borrowers

- Not accredited by major industry organizations (AADR, IAPDA)

- Services typically available only to those with $20,000 or more in unsecured debt

- Mixed reports about actual credit pull practices

Best for and not recommended for

Best for:

- Borrowers with decent credit who want to consolidate high-interest debt

- Individuals comfortable with debt settlement and its impact

- Consumers seeking a broker that offers both loan and settlement options

Not recommended for:

- Borrowers looking exclusively for a personal loan

- Individuals with less than $20,000 in unsecured debt

- Anyone unwilling to risk temporary credit damage

How to apply with SilverLake Financial

a. Respond to a pre-qualification mailer or apply online

b. Submit your financial documents

c. Receive either:

- A loan offer, or

- A referral to a debt settlement provider

d. Review and sign the agreement

e. Begin making payments as scheduled

Important: Ask directly, “Is this a loan or a debt settlement program?” before you sign.

Final verdict: Is SilverLake Financial worth it?

SilverLake Financial is a legitimate debt relief company with a decade in business, an A+ BBB rating, and hundreds of positive reviews—many highlighting the professionalism of its staff. That said, the company’s marketing strategy has drawn criticism for promoting personal loans that often lead to a debt consolidation program or debt settlement offer instead. For financially stable borrowers with good credit, SilverLake may provide access to a competitive consolidation loan. But for those in deeper financial distress, the company’s debt relief programs may carry risks such as credit damage, legal exposure, and third-party servicing confusion.

Bottom line: If you decide to move forward, go in with clear questions, written expectations, and a full understanding of whether you’re signing up for a loan or a debt consolidation program. SilverLake isn’t a scam—but it isn’t a simple solution either.

Frequently asked questions

Is SilverLake a private equity firm?

No, SilverLake Financial is not a private equity firm. It should not be confused with Silver Lake Partners, a global private equity company that manages multi-billion-dollar investment funds. SilverLake Financial is a consumer debt relief company that helps borrowers find personal loans, debt consolidation loans, or access a debt settlement program. It focuses on assisting individuals with credit card debt, monthly payments, and working toward their financial goals—not institutional investing.

How big is the SilverLake last fund?

This question refers to Silver Lake Partners, not SilverLake Financial. The last reported fund raised over $20 billion, but this data is unrelated to SilverLake Financial’s services. SilverLake Financial does not manage investment funds; it helps consumers consolidate debt, negotiate lower balances, and connect with lenders offering comprehensive loans for personal use.

What are the employee reviews of SilverLake Financial?

According to Glassdoor, SilverLake Financial reviews from employees give the company an average rating of 3.9 out of 5 stars, based on 53 reviews. Workers often mention a positive experience, with praise for the supportive team, the chance to help clients reduce monthly minimum payments, and the company’s commitment to helping customers become financially independent. Some feedback includes concerns about workload or clarity of roles, but most agree the business culture is collaborative and focused on results.

Is SilverLake Financial legit?

Yes, SilverLake Financial is a legit debt relief company founded in 2015 and based in Newport Beach, California. It holds an A+ rating from the Better Business Bureau and is known for helping clients consolidate debt, save money, and reduce interest through either a consolidation loan or a debt settlement program. However, customer reviews and negative feedback indicate that some people who expected a personal loan were instead offered a settlement solution—so it’s crucial to read the fine print and ask clear questions about the entire process before moving forward. Whether you’re trying to reduce payments, cover credit card balances, or reach your financial goals, be sure to confirm what services you’re agreeing to.

Sponsored Advertising Content:

Advertorial or Sponsorship User published Content does not represent the views of the Company or any individual associated with the Company, and we do not control this Content. In no event shall you represent or suggest, directly or indirectly, the Company's endorsement of user published Content.

The company does not vouch for the accuracy or credibility of any user published Content on our Website and does not take any responsibility or assume any liability for any actions you may take as a result of reading user published Content on our Website.

Through your use of the Website and Services, you may be exposed to Content that you may find offensive, objectionable, harmful, inaccurate, or deceptive.

By using our Website, you assume all associated risks.This Website contains hyperlinks to other websites controlled by third parties. These links are provided solely as a convenience to you and do not imply endorsement by the Company of, or any affiliation with, or endorsement by, the owner of the linked website.

Company is not responsible for the contents or use of any linked website, or any consequence of making the link.

This content is provided by New Start Advantage LLC through a licensed media partnership with Inquirer.net. Inquirer.net does not endorse or verify partner content. All information is for educational purposes only and does not constitute financial advice. Offers and terms may change without notice.