Advertorial or Sponsorship User published Content does not represent the views of the Company or any individual associated with the Company, and we do not control this Content. In no event shall you represent or suggest, directly or indirectly, the Company's endorsement of user published Content.

The company does not vouch for the accuracy or credibility of any user published Content on our Website and does not take any responsibility or assume any liability for any actions you may take as a result of reading user published Content on our Website.

Through your use of the Website and Services, you may be exposed to Content that you may find offensive, objectionable, harmful, inaccurate, or deceptive.

By using our Website, you assume all associated risks.This Website contains hyperlinks to other websites controlled by third parties. These links are provided solely as a convenience to you and do not imply endorsement by the Company of, or any affiliation with, or endorsement by, the owner of the linked website.

Company is not responsible for the contents or use of any linked website, or any consequence of making the link.

TurboDebt: What Online Reviews Are Saying

Being in debt is a terrible feeling. It can often feel insurmountable and discouraging. According to Federal Reserve data, over 60% of Americans currently owe some form of long-term debt. Finding the right debt relief solutions can completely change lives.

While taking on debt is an unavoidable part of life for many, trying to pay off multiple creditors each month can get extremely taxing. To help avoid this never-ending battle, debt relief companies aim to help you by negotiating with your lenders to reduce outstanding balances.

There’s many debt relief options, so it’s crucial to analyze user reviews to help you make an informed decision. In this article We’re doing a full breakdown of TurboDebt, and what customers have to say about their service. TurboDebt is one of the largest debt relief organizations in America. This means there are various sources to examine user feedback from.

Our goal is to help you make an informed choice on resolving debt by highlighting relevant testimonials and reviews of current and former clients of TurboDebt. The findings may surprise you.

What is TurboDebt?

TurboDebt is a debt relief company that offers specialized debt settlement services to help people manage their unsecured debts and take back control of their finances. They have cultivated a highly regarded presence in the debt relief industry since their inception in 2008.

TurboDebt has built its reputation on trusted financial guidance and commitment to helping clients navigate the murky waters of debt relief. They place emphasis on trust through listening closely to their clients goals and concerns, in order to tailor a perfect debt relief solution for each individual.

Whether you’re struggling with credit card debt, medical bills, or personal loans, TurboDebt is able to offer specialized debt settlement solutions designed to set your path to financial stability.

Understanding Turbo Debt’s Services

Founded in 2008 and headquartered in Grand Rapids, Michigan, TurboDebt aims to help “over-extended consumers get out of debt faster.” They operate nationwide and assist with the settling of unsecured debt. TurboDebt gives debtors an alternative in order to avoid bankruptcy.

TurboDebts’ solution involves negotiating with creditors to settle balances for less than the full amount owed. According to data collected in 2023 they average 54.19% in debt savings. Customers make monthly payments to TurboDebt, which they can then use to resolve debts.

It’s important to note that TurboDebt requires a minimum of $10,000 in unsecured debt to enter their program. TurboDebt is unavailable in Oregon, Vermont, and West Virginia.

While debt relief services may seem like a no-brainer for debtors, it’s critical to remember they’re long-term commitments; Sometimes up to five years. Fees are also always involved (These will be covered later). Another grave cost of any debt relief service is the impact on credit. Missed credit payments are part of the settlement process, and can take years to recover.

Analyzing reviews which document varying experiences is essential before signing up for any long term commitment, especially if they affect your money.

Sources for Reviews: Where to Find Trustworthy Turbo Debt Feedback

It’s understandable to seek an immediate solution to large debt. However, making a hasty financial decision with no research can create more fires than it puts out.

In order to gather helpful customer data on TurboDebt, we’ll look at feedback across the credible rating platforms Better Business Borough, Google, and Trust Pilot. Review criteria will include customer service, success rates, and communication.

The data should be varied and inclusive of all points of views and experiences. This way you can make a truly informed decision regarding TurboDebt.

Google Reviews

As the world’s largest search engine, Google indexes reviews from sources all over the web. With over 6,763 Google reviews for Turbo Debt at the time of writing, this is a sizable sample to gauge general satisfaction levels. Current rating for TurboDebt based on Google Reviews is 4.9

Pros: Wide range of perspectives. Cons: Individual reviews can lack details and relevant context.

Better Business Bureau (BBB) Reviews

The BBB is a trusted watchdog that effectively holds businesses accountable for any malpractice. TurboDebt currently holds an impressive 4.91 rating based on 1,297 plus reviews, though it has fluctuated in the past. Analyzing their BBB profile reveals detailed feedback.

Pros: specific details on complaint resolutions provided. Cons: Reviews are limited in number compared to platforms like Google or Trustpilot.

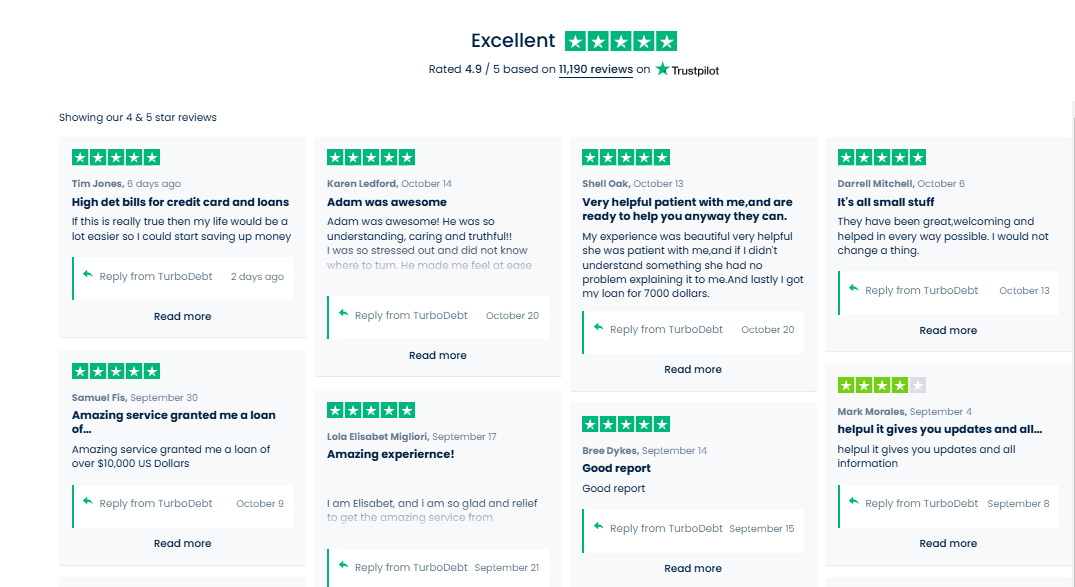

Trustpilot Reviews

With a 4.9-star rating based on over 12,000 reviews, Trustpilot users have given Turbo Debt largely rave reviews. Written comments should also be weighed, however.

Pros: Large sample size for statistical significance. Cons: There are more concerns about fake accounts than Google.

Now that we’ve established our review platforms to be used, let’s analyze the overarching themes behind user comments regarding TurboDebt, both positive and negative.

Turbo Debt Success Stories: Debt Relief Done Right?

In-depth analysis of over a hundred reviews reveals that TurboDebt does indeed significantly reduce debt, as long as negotiations go according to plan. Savings in the neighborhood of 54.19% before fees—or 25% including costs—are frequently cited.

One incredible result had a debtor only have to pay $6,000 out of $66,000 he owed in medical expenses thanks to TurboDebts service.

Aside from monetary results, top-rated elements of Turbo Debt’s service include attentive customer support staff, ease of use that “took the stress out” of tackling debt, and clear program phases. As one satisfied client mentions, “The company makes it very simple to understand what is going on and keeps you updated at each step.” This transparency and communication is highly appreciated by customers.

Reviewers have frequently acknowledged Turbo Debt advisors as being empathic and genuine. They make clients feel truly cared for rather than feeling “like another number.” As a debtor that was successfully relieved of $53,000 in loans recounts, the organization “held my hand through the process.” For reviewers that are lacking financial know-how, guidance on budgets to prevent recurring debt is deeply appreciated.

Positive reviews of TurboDebt highlight the successful improvement in clients’ financial health, while showcasing the positive outcomes achieved through their programs. Customer service is also heavily praised for empathy, communication, and clarity.

Addressing Criticisms: Turbo Debt Complaints

Of course, no service is completely devoid of criticism, no matter how well received. While the number of positive reviews far outweighs negative feedback, complaints still exist. Understanding negative feedback is important for any business to improve, and any prospective client to make the most informed decision possible.

A common Turbo Debt complaint regards wait times, whether to receive debt analyses or for creditor negotiations to conclude. While usually under 6 months, cases of 12-18 months can be extremely frustrating for some reviewers.

A few debtors also feel they weren’t given proper warning of hefty service fees, especially as they build over time. Sometimes these fees can have the same total as the debt balance.

Lesser critiques reference long hold times to reach representatives, inconsistency between agents regarding certain requirements, or a belief that savings achieved didn’t justify charges ultimately paid. However, many reviewers willingly acknowledged that staff tried their best to remedy complaints.

Something interesting came up when researching BBB complaints classified as ‘resolved’. Apparently TurboDebt frequently waives or refunds fees—even years after service—for clients contesting situations outside their control during the debt relief process. This demonstrates that Turbodebt has honest integrity for their services and are committed to their customers well being.

Understanding TurboDebts Processes and Communication Standards

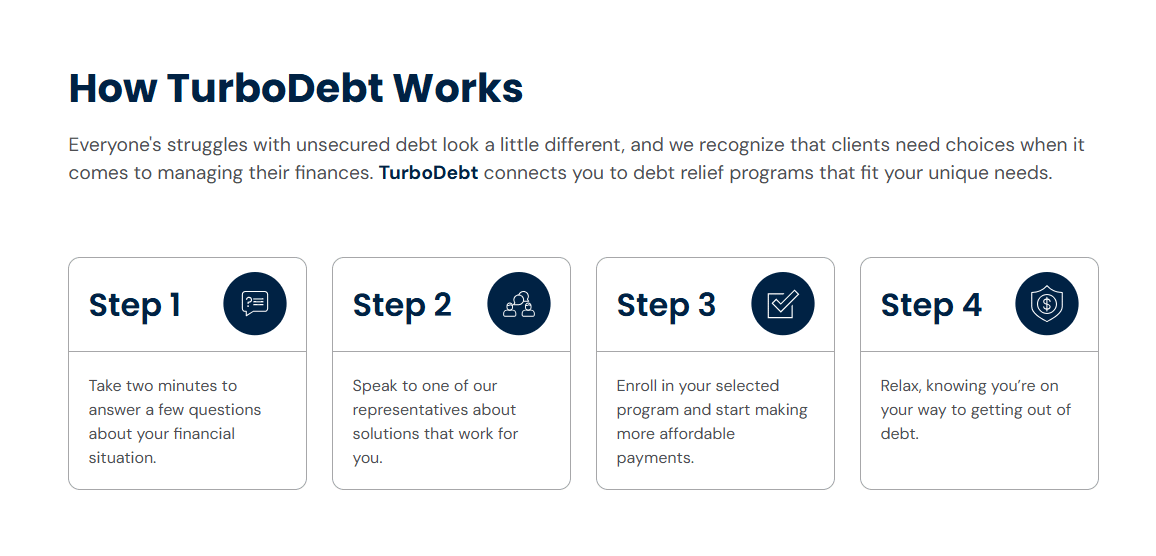

The Initial Consultation

New clients begin with an analysis of needs, generally by phone. Representatives assess all debts and income/expenses and create customized proposals. No charges apply at this introductory phase. Financial counseling is entwined in negotiations to reform spending habits.

The Enrollment Process

Once accepted into a program, 25% of the total enrolled unsecured debt balances become due as non-refundable fees. They are withdrawn via monthly payments to cover ongoing creditor discussions. These are handled by specialized settlement agents, who’ve resolved billions of dollars in liabilities over the years, according to TurboDebt. This 25% fee is in compliance with FTC regulations for debt relief services.

Timeline Expectations

Most complete the service in 2-5 years on average, depending on individual circumstances, It’s possible to finish sooner though. Debt amounts, original agreement specifics, and customer cooperation impact outcomes. Communication is bimonthly at a minimum, though clients desire more frequency, according to some review dats. Periodic status reports document efforts throughout.

Negotiation Results

TurboDebt boasts of settling 80% of creditors for 50% or less than balances owed, guaranteeing returns if negotiations fail to achieve promised reductions. Though not entirely regulated, they maintain accreditation with the Better Business Borough (BBB), American Association for Debt Resolution (AADR), and International Association for Professional Debt Arbitrators (IAPDA) .

Transparency seems to be a Turbo Debt strength—both about the inner workings described online and representatives’ willingness to address queries according to feedback. Standard processes aim for clarity, though variations in individual outcomes or communication styles occur as with any large-scale operation.

Debt Relief Options

Debt settlement can be a viable option for those who are unable to pay their debts in full but can make a lump-sum payment. TurboDebt ensures that clients have access to the right tools and strategies to address their specific financial challenges.

Benefits of Working with TurboDebt

- Expert Guidance and Support: TurboDebts team of experienced debt consultants provide expert guidance and support throughout the debt relief process. Their knowledge and expertise can help you navigate the complexities of debt management and find the best solutions for your situation.

- Personalized Debt Relief Plans: TurboDebt creates personalized debt relief plans tailored to each individual’s financial situation. This customized approach ensures that your debt relief strategy is aligned with your unique needs and goals.

- Debt Reduction: Through debt settlement and negotiation, Turbo Debt can help reduce the amount of debt owed. This can result in significant savings and make it easier to pay off your debts.

- Lower Monthly Payments and Interest Rates: Debt consolidation can lead to lower monthly payments and interest rates, making it easier to manage your financial obligations and stay on track with your payments.

- A Debt-Free Life and Financial Freedom: TurboDebts genuine goal is to help you achieve a debt-free life and enjoy financial freedom. With their support and guidance, you can take control of your finances and work towards a more secure and stable financial future.

In summary, TurboDebt offers a comprehensive range of debt relief options and personalized support to help individuals overcome their financial challenges and achieve lasting financial freedom through effective financial planning.

Making Sense of Fees: Are TurboDebts Prices Competitive?

Egregious charges for debt relief services can feel like a betrayal of trust to customers. With some TurboDebt clients expressing confusion over unforeseen fees, understanding their frameworks is essential. Their programs levy a 25% fee calculated on total start-of-service balance. This is roughly industry standard.

There are zero upfront fees for TurboDebts services. A standard fee of 25% is collected only after debt is successfully settled by the company.

When assessing Turbo Debt fees relative to potential debt savings, one debtor summarized, “The fees were worth it to get out of debt that much quicker.”

Turbodebt will also refund 100% of paid charges if agreed-upon reductions aren’t met. This is a reassuring feature for potential customers. While not a perfect fit for all budgets, their framework seems relatively affordable in the debt relief sector.

Making an Informed Choice: Key Takeaways and Final Thoughts

- Many find TurboDebt helpful for resolving unsecured debt through negotiated settlements, though wait times vary.

- While fees exist, as with comparable services, guarantees and a willingness to address complaints soften their impact, according to feedback.

- Signing on requires long-term dedication, open communication, and sometimes consenting to procedural variations outside representatives’ control.

- Credit score will likely take a big hit, as you will not be making payments on your credit until your payments to TurboDebt are complete

- Ratings are overwhelmingly positive on aggregate review platforms, tempered by examining all customer sentiments—good and bad.

- Potential savings of 54.19% before fees or 25% including costs make Turbo Debt pricing competitive versus alternatives for qualifying candidates.

TurboDebt is a legitimately worthy debt relief approach. As with any major financial commitments, independent research across various trusted review sources lends the knowledge required for well-informed decisions. Hopefully, this in-depth guide will provide a balanced perspective on both the pros and cons that should be considered.

FAQs

Is Turbo Debt a legitimate debt relief company?

Yes, Turbo Debt is a reputable debt relief organization that has assisted thousands of clients over many years of operation. It is also active in leading industry associations.

How much can I expect to pay for Turbo Debt’s services?

25% of the total debt is enrolled in their program. Fees are withdrawn as part of monthly payments during the debt relief process, which takes 2-4 years on average.

What types of debt does Turbo Debt help manage?

Unsecured debts like credit cards, medical bills, personal loans, tax debt, and some tax obligations. They do not deal with debts secured by assets like mortgages or vehicle loans.

How long does the Turbo Debt program usually take?

Most clients complete their debt relief plan within 24-48 months. Some cases may take less or more time, depending on individual circumstances. The national average time is around 3 years.

Will using Turbo Debt affect my credit score?

Yes, credit takes a big hit. It can take years to improve your credit score after using TurboDebts services. This is because your payments will be going their way instead of towards your credit.

Sponsored Advertising Content:

Advertorial or Sponsorship User published Content does not represent the views of the Company or any individual associated with the Company, and we do not control this Content. In no event shall you represent or suggest, directly or indirectly, the Company's endorsement of user published Content.

The company does not vouch for the accuracy or credibility of any user published Content on our Website and does not take any responsibility or assume any liability for any actions you may take as a result of reading user published Content on our Website.

Through your use of the Website and Services, you may be exposed to Content that you may find offensive, objectionable, harmful, inaccurate, or deceptive.

By using our Website, you assume all associated risks.This Website contains hyperlinks to other websites controlled by third parties. These links are provided solely as a convenience to you and do not imply endorsement by the Company of, or any affiliation with, or endorsement by, the owner of the linked website.

Company is not responsible for the contents or use of any linked website, or any consequence of making the link.

This content is provided by New Start Advantage LLC through a licensed media partnership with Inquirer.net. Inquirer.net does not endorse or verify partner content. All information is for educational purposes only and does not constitute financial advice. Offers and terms may change without notice.