Advertorial or Sponsorship User published Content does not represent the views of the Company or any individual associated with the Company, and we do not control this Content. In no event shall you represent or suggest, directly or indirectly, the Company's endorsement of user published Content.

The company does not vouch for the accuracy or credibility of any user published Content on our Website and does not take any responsibility or assume any liability for any actions you may take as a result of reading user published Content on our Website.

Through your use of the Website and Services, you may be exposed to Content that you may find offensive, objectionable, harmful, inaccurate, or deceptive.

By using our Website, you assume all associated risks.This Website contains hyperlinks to other websites controlled by third parties. These links are provided solely as a convenience to you and do not imply endorsement by the Company of, or any affiliation with, or endorsement by, the owner of the linked website.

Company is not responsible for the contents or use of any linked website, or any consequence of making the link.

CashNetUSA: Reviews and Ratings

Unexpected expenses—whether medical bills, car repairs, or other financial emergencies—can create immediate financial stress. With so many online lending options available, it’s essential to distinguish reputable lenders from those with excessive fees or predatory practices.

In this review, we take a closer look at CashNetUSA, a well-known short-term lender offering payday loans, installment loans, and lines of credit.

We’ll explore real customer experiences, loan terms, potential risks, and whether this is a smart financial choice—or if better alternatives exist.

What is CashNetUSA?

CashNetUSA has been in the lending game since the early 2000s. Based in Illinois, this outfit specializes in short-term loans that can tide you over until payday. Think of it like a pawn shop but without the haggling over grandma’s wedding ring.

Customers can access funds in two main ways: payday loans (a lump sum to repay all at once) or installment loans (a fixed amount paid back over time). Loan amounts vary by state, with a typical maximum of $3,000 based on lending laws. Installment loans cater to folks who need small sums ASAP rather than those seeking big-ticket items.

CashNetUSA Loan Features

CashNetUSA offers short-term loans, including payday loans, installment loans, and lines of credit (LOCs). However, loan terms, fees, and availability vary significantly depending on your state of residence.

Loan Types & Availability

They provide three main types of loans:

- Payday Loans: Lump-sum loans that must be repaid in full—plus fees—on your next payday.

- Installment Loans: Borrowers can repay in fixed payments over 3 to 24 months, but only available in 3 states.

- Lines of Credit (LOCs): A revolving credit option where you borrow as needed up to an approved limit, available in only 10 states.

State Restrictions: CashNetUSA loans are not available in all 50 states.

- Installment loans: Offered in just 3 states.

- Lines of credit: Available in only 10 states.

- Payday loan availability depends on local lending laws.

Before applying, check whether they operate in your state.

READ MORE: How to Qualify for a Loan: Step-by-Step Guide to Qualifying with Confidence

Loan Costs & Fees

While CashNetUSA provides fast cash, the cost of borrowing is extremely high, making it a risky long-term financial option.

- APR Range: Interest rates typically range from 200% to over 400%, depending on state regulations.

- LOC Transaction Fees: A 15% transaction fee applies to each cash advance on a line of credit, adding substantial borrowing costs.

- Late Fees: Borrowers who miss payments incur late fees and potential penalties, which vary by state.

- Early Repayment: No prepayment penalties—borrowers can pay off loans early to reduce interest costs.

Example Cost Breakdown (Typical State Rates)

- A $500 payday loan might cost $625-$750 to repay within two weeks.

- An installment loan of $1,500 over six months could result in a total repayment of $2,500+ due to interest.

Repayment Terms & Consequences

- Payday loans: Must be repaid in one lump sum within two weeks to one month.

- Installment loans: Paid in fixed monthly payments over 3 to 24 months.

- Lines of credit: Minimum payments are required, but high fees make carrying a balance costly.

What Happens If You Miss a Payment?

- Late fees may be charged.

- Collection efforts begin immediately—including calls, emails, and letters.

- CashNetUSA does not report directly to credit bureaus, but if your loan is sent to collections, it can impact your credit score.

Warning: Due to the extremely high APRs and fees, borrowers should only use CashNetUSA as a last resort and only if they can repay the loan quickly.

CashNetUSA Customer Reviews

When analyzing customer experiences, opinions are divided. While some borrowers praise the fast approval process and same-day funding, others warn about excessive fees, aggressive collections, and even potential scams. Here’s a deeper look at what customers are saying, including insights from Reddit discussions.

Positive Reviews: Quick Funding & Easy Application

Many customers highlight speed and convenience as its strongest qualities. Common praises include:

- Fast Approvals & Funding: Borrowers who submitted their applications early in the day often received funds the same business day.

- No Hard Credit Check: Many customers with bad credit were able to qualify when traditional lenders denied them.

- Fully Online Process: Users liked that they didn’t have to visit a physical location, making it easy to apply.

A typical positive review reads:

“I needed cash for an emergency car repair, and CashNetUSA got me approved in less than an hour. The money was in my account before dinner!”

However, despite these benefits, many users caution that it should only be used for short-term emergencies due to its extreme costs.

Negative Reviews: High Fees, Collection Issues & Payment Problems

While they deliver on speed, many borrowers report that repayment becomes a nightmare due to high APRs and aggressive collection tactics.

1. High-Interest Rates & Fees

- APRs range from 200% to over 400%, making loans difficult to repay without falling into a cycle of debt.

- Late fees add up quickly, and some users report that even small delays result in large penalties.

- Lines of credit include a 15% transaction fee for each withdrawal, significantly increasing the borrowing cost.

One frustrated borrower shared:

“I borrowed $700, but by the time I paid it off, I had paid back nearly double. I wouldn’t recommend this unless you can afford to repay fast.”

2. Aggressive Debt Collection Practices

- Users on Reddit warn that the collections department is relentless.

- Some reported repeated phone calls, letters, and even threats of legal action if payments were missed.

- If an account remains unpaid, they may sell the debt to a third-party collections agency, which can harass borrowers for payment.

One Redditor wrote:

“CashNetUSA kept calling me at work, at home, and even contacted my references. I felt completely harassed.”

Another added:

“They won’t directly report to credit bureaus, but if they sell your debt to collections, THEY might report it. I had to fight to remove a collections account from my credit report.”

3. Credit Reporting Confusion

There’s conflicting information on how CashNetUSA impacts credit scores:

- They do not directly report to major credit bureaus (Experian, Equifax, TransUnion).

- However, if the loan is sent to collections, it can negatively impact credit scores.

- Some borrowers report that collections agencies delete negative marks once settled, but this isn’t guaranteed.

A Reddit user advised:

“If you default, collections agencies take over. Some delete the record after payment, but don’t count on it. Avoid this loan unless you can repay it fast.”

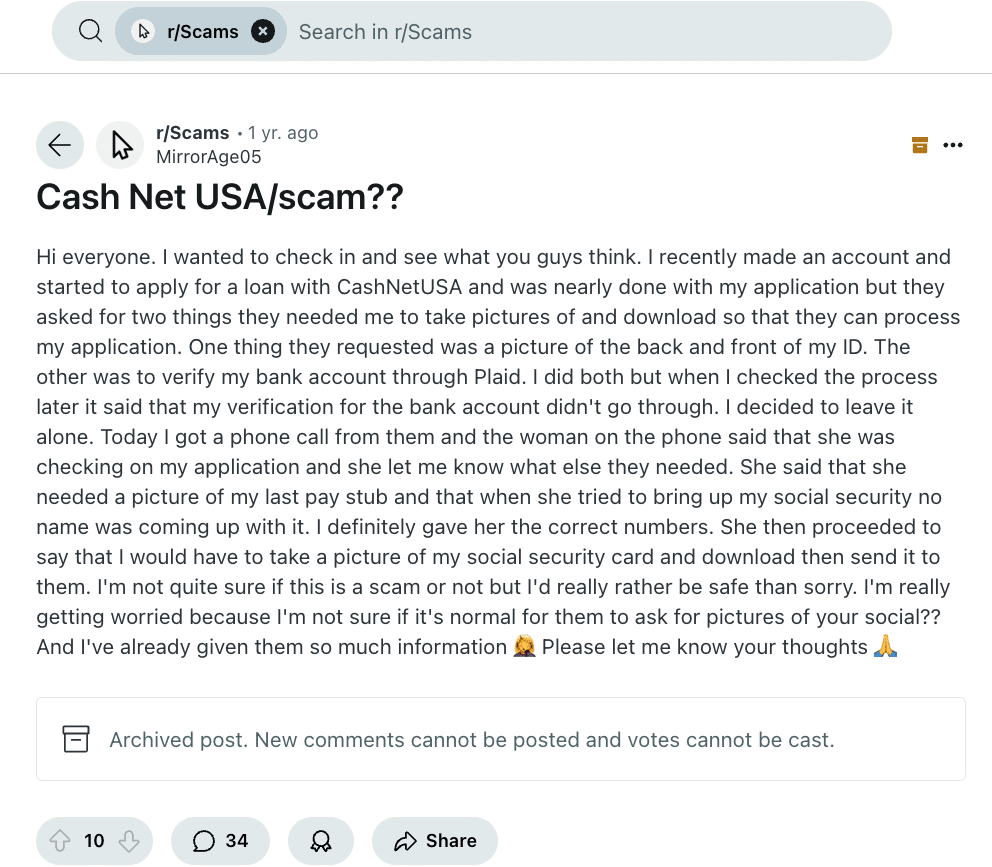

4. Potential Scam Concerns

Some borrowers have reported scam attempts using CashNetUSA’s name. If a lender requests unusual documentation, such as a photo of your Social Security card, this could indicate fraud. Always verify loan-related communications by calling them directly at 888-801-9075 and avoid sharing sensitive information through email or text.

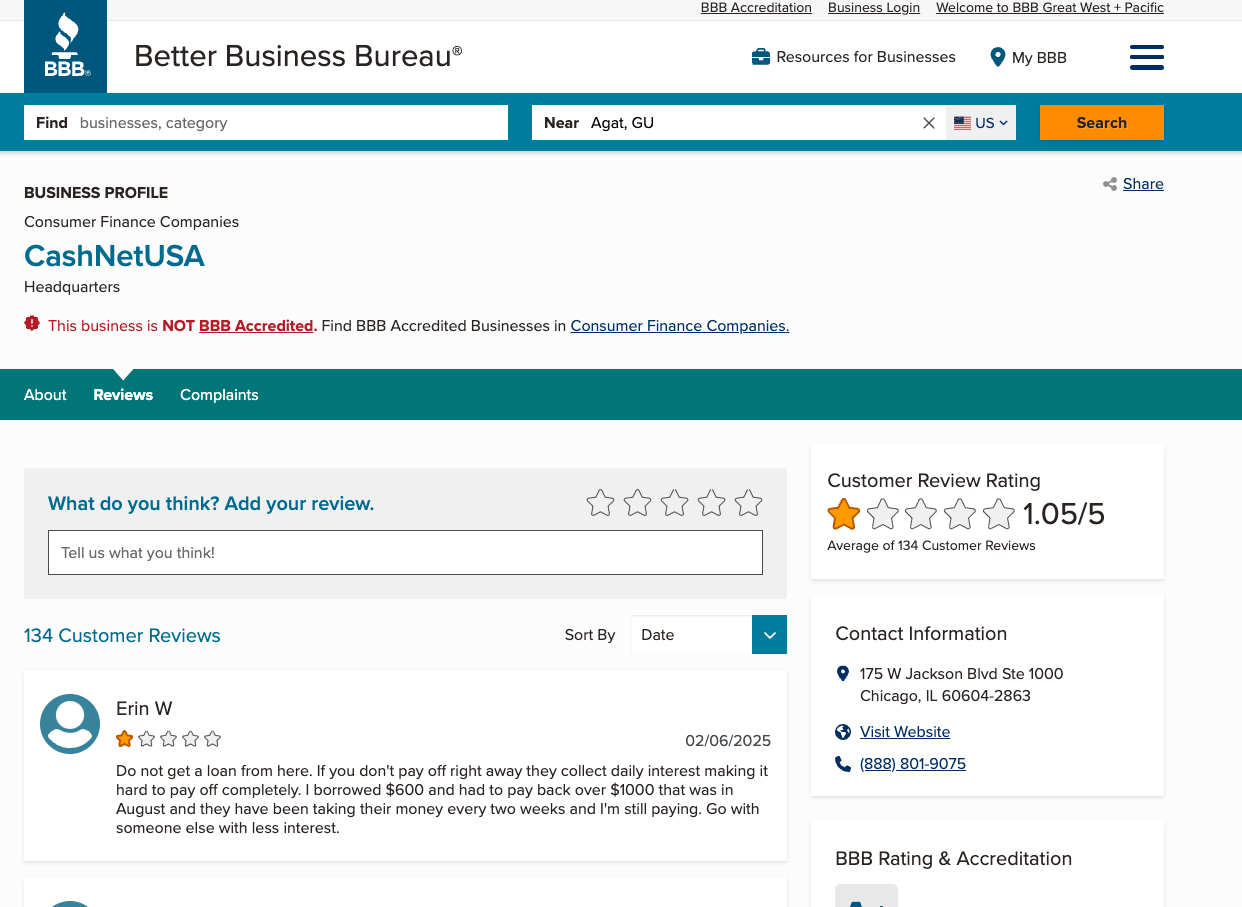

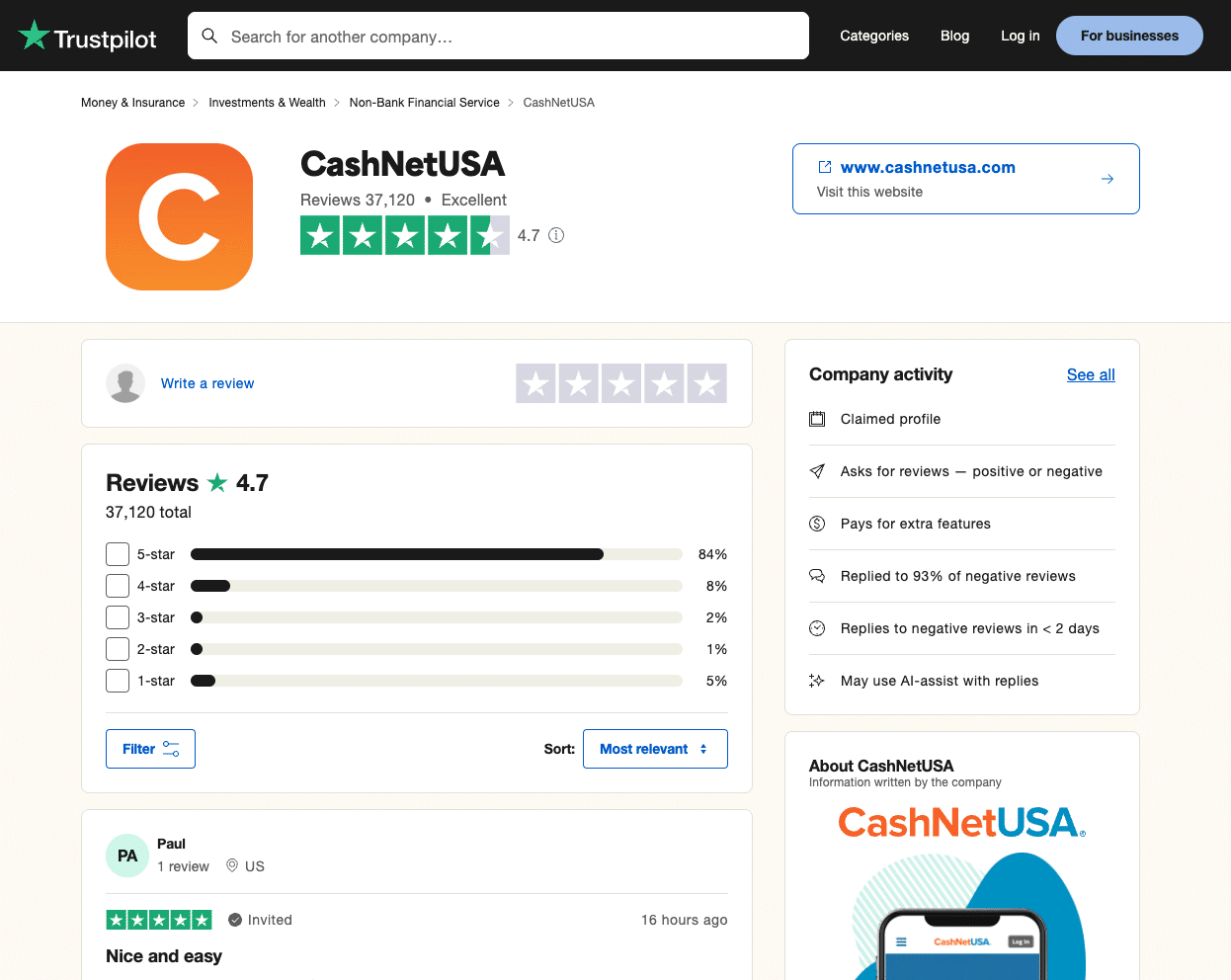

CashNetUSA Ratings Across Review Platforms

CashNetUSA holds an A+ rating from the BBB, but customer complaints tell a different story. The BBB customer rating is just 1.05 out of 5, with many borrowers citing repayment difficulties and aggressive collections.

Meanwhile, Trustpilot reviews are significantly more positive at 4.7/5, primarily due to fast approvals and funding. This contrast suggests that while CashNetUSA delivers quick cash, repayment, and customer service can be problematic for some borrowers.

Pros and Cons of Using CashNetUSA

Pros

- Loan approval usually within an hour for qualified borrowers

- No physical branch visits required – fully online application

- Operates in many states for convenience

Cons

- Annual percentage rates (APRs) range from 200-400% typically

- Short payment periods of usually two weeks for payday loans

- Not available to residents in all 50 US states yet

In summary, positives include swift funding and a paperless process. However, the high costs and limited state access mean it may only suit some budgets. Your needs depend heavily on individual circumstances. Always compare all options before committing.

Late Payment on CashNetUSA

If a borrower misses or is late on a payment with them, there are a few potential consequences:

Late Fees: They will likely charge a late fee, which is a penalty for missing the due date. The amount of the late fee varies by state but is often around $25-30.

Negative Reporting to CCRs: They may report missed/late payments to consumer credit reporting agencies like Equifax, Experian, and TransUnion. This could negatively impact your credit score.

Acceleration of Debt: For installment loans, they have the right to accelerate the balance if payments are late. This means the full remaining balance becomes due immediately instead of in future installments.

Collection Calls: They use internal and external collection agencies to recoup unpaid debts. This could involve early morning or late night calls and letters that continue until payment is made.

Legal Action: As a last resort, they may sue borrowers to garnish wages or seize bank accounts/assets if unpaid debt collection efforts fail, though this is rare for small-dollar loans.

Late or missed payments can cost you late fees, damaged credit scores, accelerated loan balances, harassing collection calls, and possibly even legal proceedings. Borrowers need to repay their loans on time for every single period.

Should You Choose CashNetUSA?

CashNetUSA delivers on speed, but the sky-high interest rates, aggressive collections, and potential scam risks make it a high-risk option for borrowers. While it can provide quick emergency cash, it should be used with extreme caution.

Who Should Consider:

- Borrowers with no other options who need fast cash for emergencies.

- People who can repay quickly to minimize fees and interest.

Who Should Avoid:

- Anyone who struggles with repayment—late fees and collections add up fast.

- Borrowers who qualify for lower-cost alternatives such as credit unions, paycheck advances, or personal loans.

- People worried about scams—some users report requests for excessive personal data that could be fraudulent.

Warning Before You Apply

- High APRs (200-400%) make repayment difficult.

- Lines of credit have a 15% transaction fee per withdrawal.

- Missed payments lead to aggressive collection efforts.

- Defaulting can result in debt being sold to collections, hurting credit scores.

- Scam risks exist—always verify lender legitimacy before submitting documents.

Final Verdict: Think Twice Before Borrowing

CashNetUSA is a high-cost lender that should only be considered if no other options are available. The combination of APRs exceeding 200-400%, high transaction fees for lines of credit, and aggressive collection practices make these loans a financial risk.

If you must borrow, ensure you can repay quickly to avoid long-term financial harm. Exploring lower-cost alternatives should always be your first step before turning to high-interest payday lenders.

FAQs

Is CashNetUSA a legitimate lender?

Yes, they have been a licensed lending operation since 2001 with over 16+ years in business.

What is the lawsuit against CashNetUSA?

The lawsuit claims that their online lending practices in Pennsylvania were unlawful, violating multiple state regulations, including the Loan Interest Protection Law, the Pennsylvania Consumer Discount Company Act (CDCA), and the Unfair Trade Practices and Consumer Protection Laws.

What is the minimum credit score for CashUSA?

CashUSA does not specify a minimum credit score requirement. However, since it works with a network of lenders, individuals with poor credit still have the opportunity to apply.

Does CashNetUSA approve everyone?

According to them, having a low credit score can make securing a personal loan challenging, especially in emergencies. While approval isn’t guaranteed, they evaluate an applicant’s overall financial situation rather than just their credit score, potentially offering loans to those who might not qualify with traditional banks.

What happens if you don’t pay CashNetUSA?

If you fail to repay a loan from them, the lender has several options to recover the debt. They may file a lawsuit against you, transfer the debt to a collection agency for recovery, or sell it to a third-party debt buyer.

Sponsored Advertising Content:

Advertorial or Sponsorship User published Content does not represent the views of the Company or any individual associated with the Company, and we do not control this Content. In no event shall you represent or suggest, directly or indirectly, the Company's endorsement of user published Content.

The company does not vouch for the accuracy or credibility of any user published Content on our Website and does not take any responsibility or assume any liability for any actions you may take as a result of reading user published Content on our Website.

Through your use of the Website and Services, you may be exposed to Content that you may find offensive, objectionable, harmful, inaccurate, or deceptive.

By using our Website, you assume all associated risks.This Website contains hyperlinks to other websites controlled by third parties. These links are provided solely as a convenience to you and do not imply endorsement by the Company of, or any affiliation with, or endorsement by, the owner of the linked website.

Company is not responsible for the contents or use of any linked website, or any consequence of making the link.

This content is provided by New Start Advantage LLC through a licensed media partnership with Inquirer.net. Inquirer.net does not endorse or verify partner content. All information is for educational purposes only and does not constitute financial advice. Offers and terms may change without notice.