Advertorial or Sponsorship User published Content does not represent the views of the Company or any individual associated with the Company, and we do not control this Content. In no event shall you represent or suggest, directly or indirectly, the Company's endorsement of user published Content.

The company does not vouch for the accuracy or credibility of any user published Content on our Website and does not take any responsibility or assume any liability for any actions you may take as a result of reading user published Content on our Website.

Through your use of the Website and Services, you may be exposed to Content that you may find offensive, objectionable, harmful, inaccurate, or deceptive.

By using our Website, you assume all associated risks.This Website contains hyperlinks to other websites controlled by third parties. These links are provided solely as a convenience to you and do not imply endorsement by the Company of, or any affiliation with, or endorsement by, the owner of the linked website.

Company is not responsible for the contents or use of any linked website, or any consequence of making the link.

MoneyLion: Reviews and Ratings

Nowadays, a new fintech app appears almost weekly, promising to make managing your finances easier.

But with so many options out there, how do you know which one is actually going to help rather than hassle? Well, buckle up, friends, because we’re here to spill the beans on MoneyLion – one of the biggest players in the personal finance app game.

MoneyLion has been around for a while and has gained a solid reputation. It connects millions of people with essential financial products and delivers curated content, emphasizing its mission to empower consumers to make informed financial decisions. MoneyLion’s mission is to provide accessible financial solutions and guidance, fostering confidence and engagement in financial literacy.

In this review, we’ll give you the lowdown on everything they offer and what actual users are saying. Stick around, and by the end, you’ll have a good idea if MoneyLion’s your lion or not!

What is MoneyLion?

As with any popular app, MoneyLion didn’t start on top. Launched back in 2013, it originally focused on bringing banking services to underserved communities. But now, nearly a decade later, It’s evolved into a true one-stop shop for your finances.

My research shows they’ve helped over 2 million members control their cash flow with offerings like no-fee banking, credit tools, and financial advice customized just for them. MoneyLion’s core mission is still about making personal finance simpler, too—a noble goal!

MoneyLion’s enterprise technology serves as a robust digital ecosystem that powers personalized financial products and services.

MoneyLion’s mission to empower consumers to make informed financial decisions through personalized financial products and services remains at the forefront of their efforts.

So whether you’re looking to get out of debt, save up for a goal, or need access to spending cash, MoneyLion likely has a solution. The wide variety of features is surely a big part of its appeal.

Key MoneyLion Services: Innovative Financial Products

MoneyLion offers a tailored feed, a personalized content feed designed to engage users in learning about finance.

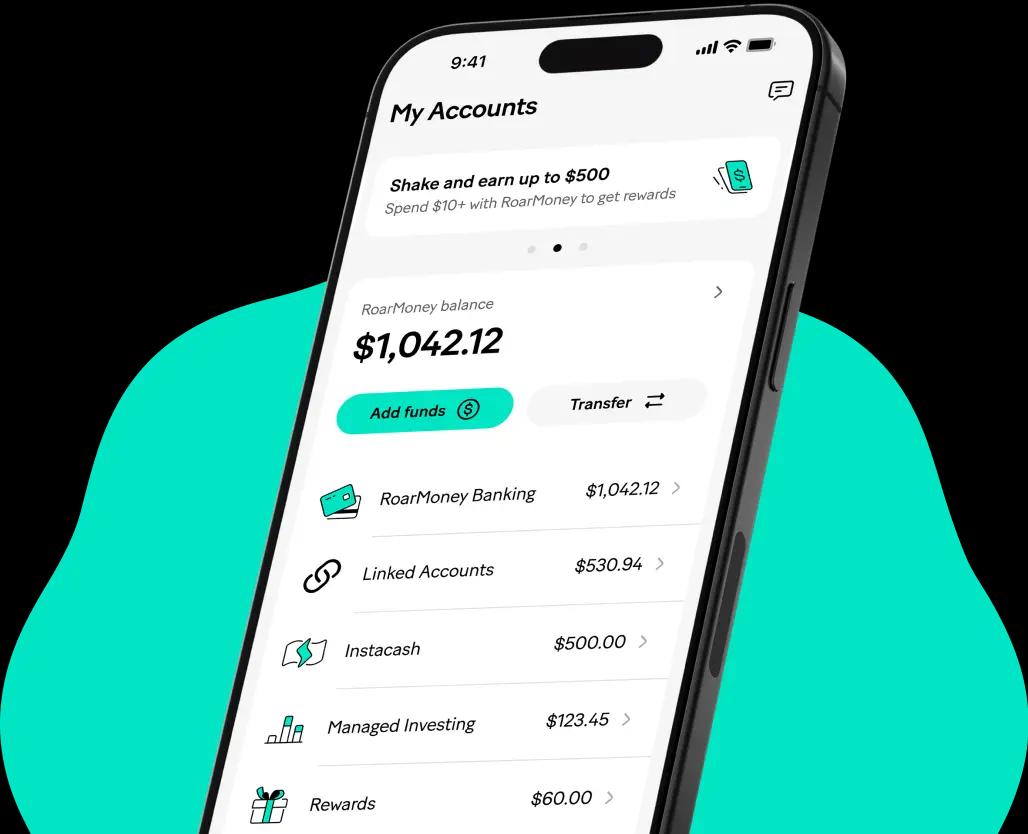

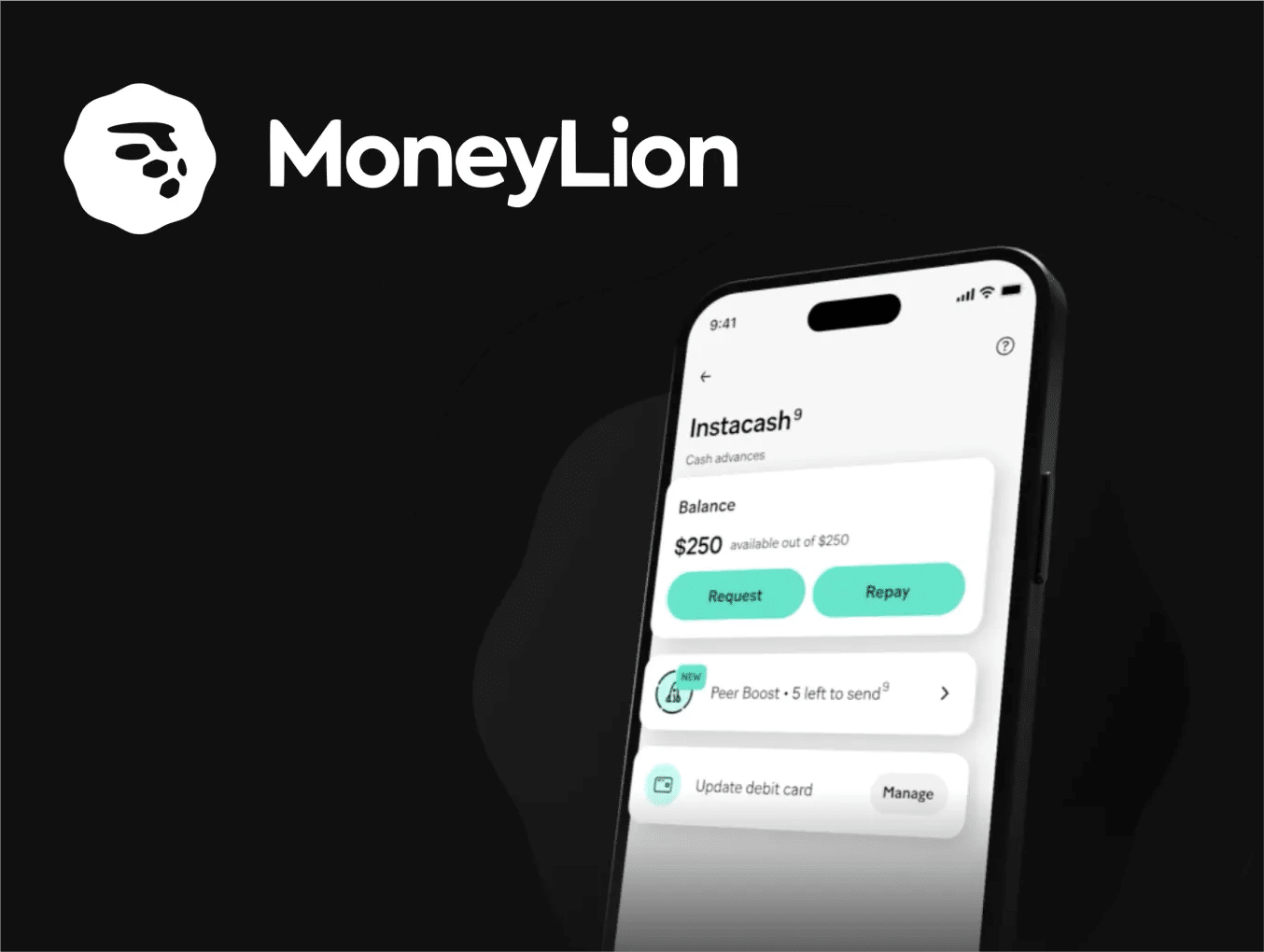

Mobile Banking and Cash Advance Services

The RoarMoney app offers full-service banking, complete with early paycheck deposits, cashback rewards, and 55,000+ free ATMs nationwide. Members also get access to no-interest Instacash cash advances up to $500 for strictly voluntary usage fees.

MoneyLion is often considered the go-to money app because it offers a comprehensive digital platform that provides personalized financial products and services.

Credit Building and Monitoring

Credit Builder Plus membership provides credit monitoring, personalized coaching videos, and a secured loan reported to all three bureaus to build your score. According to MoneyLion, members often see 25+ point increases within two months. MoneyLion leverages advanced AI-backed data to provide personalized coaching and credit monitoring services, enhancing users’ financial decision-making.

Investment and Crypto Options

Through MoneyLion’s automated and managed portfolios, investing as little as a buck is made simple. They also allow the buying and selling of Bitcoin and other digital currencies for adventurous types. MoneyLion’s investment and crypto options are part of their innovative financial products designed to empower users to make informed financial decisions.

Of course, my research also uncovered a few hidden financial gems—aka lesser-known MoneyLion tools. These include discounted insurance, gamified challenges to earn points/gift cards, student loan refinancing, and a marketplace of additional offers. All in all, it’s easy to see why MoneyLion appeals to a wide range of folks.

How Much Does MoneyLion Cost? Breaking Down the Pricing

The entry-level MoneyLion membership is completely free and has basic features like banking, Instacash advances, and credit monitoring. There are also some optional subscription upgrades available:

- MoneyLion Blue costs $9.99/month and unlocks cashback, insurance perks, and higher lending limits.

- MoneyLion Green costs $19.99 monthly but supersizes everything—from lending to insurance discounts and exclusive cashback rates.

MoneyLion offers a full-fledged suite of financial features designed to empower users to manage their finances.

As for additional charges, Instacash advances carry voluntary usage fees of $2.50-$5, while expedited transfers have $2.50 fees. There are also potential overdraft fees, but MoneyLion aims to waive most of these, too. All in all, these are very straightforward and transparent prices if you ask us!

What the People Say: MoneyLion Connects Millions – User Reviews

Most Praised Features

Across the board, ease of use and around-the-clock customer service get top ratings. Reviews also highlight how simple it is to access spending cash or track finances on the go via the easy-to-navigate mobile app. Many call out feeling more in control of their money thanks to MoneyLion’s personalized insights, too.

Areas for Improvement

On the downside, some mention occasional app glitches like bugs when trying to deposit money or pay bills. Customer service wait times also get complaints during busier periods. A few also note the learning curve for more advanced features or want additional investment options like IRAs.

All in all, though, MoneyLion maintains high ratings of 4.5+ stars on both Android and Apple stores based on hundreds of thousands of reviews. Their responsive approach to suggestions bodes well for constant refinement—not too shabby if I do say so myself!

Who Should Use MoneyLion? Weighing the Pros and Cons

Like any tool, MoneyLion isn’t a perfect fit for everyone. So, in this section, we’ll lay out some pros, cons, and ideal user scenarios to help you decide. MoneyLion’s tools and services are designed to help users make better money decisions.

Pros

- Wide range of features from banking to lending in one consolidated app

- No credit check cash advances better than payday loans

- Committed to financial literacy through education modules

- Generous rewards programs and discounts on services like insurance

Cons

- Full features require paid subscriptions beyond basic tools

- Unused extra services could lead to wasting subscription costs

- Customer service backlogs reported during high-volume periods

- It is not ideal for customizing investments beyond preset portfolios

Ideal Users: Making Smart Money Decisions

- Those seeking an all-in-one financial dashboard

- Members wanting to establish credit need Credit Builder Plus

- Individuals requiring access to spending cash between paychecks

- Users on a budget but want the cashback benefits of a banking plan

MoneyLion is a good choice if you value convenience above all else. Just be sure your needs align with their offerings versus DIY management.

In Closing: Is MoneyLion the App for You?

After checking out all that MoneyLion offers and what users have to say, it’s clear why they’ve become such a popular fintech player. With top-notch app praise and a dedicated focus on financial education, they definitely earn props in my book.

Of course, as with any service – it’s important that MoneyLion aligns with your unique needs, too. If you value full-service money tools, cash rewards, and credit optimization assistance – you likely find LOTS to like.

Just keep in mind some limitations on investment customization or potential tech hiccups, which are being actively addressed. MoneyLion’s large toolbox is tough to beat for accessible personal finance help.

Why not give their free tools a spin or do a 14-day trial membership run to see results for yourself? The proof’s really in the personal pudding, after all. You’ve got nothing to lose and finances to gain – so what are you waiting for before signing up, ya lazy lion?!

MoneyLion’s platform allows businesses to add embedded finance solutions, creating a seamless and comprehensive consumer experience. We hope this summarizes everything you wanted to know about MoneyLion. Feel free to explore their site for even more details, too.

Frequently Asked Questions: Is MoneyLion a Safe Bet?

With any large app, uncertainty is normal. So, to assuage concerns – let’s look at some commonly asked questions about MoneyLion:

MoneyLion’s platform includes embedded finance solutions that allow users to integrate financial services into their daily lives seamlessly.

What is MoneyLion’s Credit Builder Plus feature?

Credit Builder Plus membership includes a secured loan that reports payments to all three bureaus, helping to build credit over 6-12 months of on-time repayments.

The Credit Builder Plus feature is one of MoneyLion’s personalized products designed to help users build credit through tailored financial solutions.

Are there hidden fees with MoneyLion services?

While some expedited transfers have nominal processing fees, MoneyLion aims to keep core tools like banking and lending fee-free. In my experience, any potential charges are clearly disclosed upfront.

MoneyLion’s premier embedded finance platform ensures transparency and minimal hidden fees, providing users with a seamless financial experience.

Can you buy cryptocurrency through MoneyLion?

Yes, their investing features allow commission-free purchase and custody of Bitcoin and a few other digital coins if you want exposure beyond traditional assets. MoneyLion also provides curated content on related topics to help users make informed decisions about cryptocurrency investments.

How does MoneyLion compare to traditional banks?

Unlike big banks, MoneyLion prides itself on providing personalized service via its consumer-friendly mobile app. There are also fewer physical locations or minimum balance requirements for basic banking services.

MoneyLion’s platform acts as a definitive search engine for financial products, offering a comprehensive range of services that traditional banks may not provide.

Is MoneyLion a safe and secure app for managing finances?

The app claims industry-standard security, such as bank-grade encryption and two-factor authentication. When funds are kept in eligible accounts rather than invested elsewhere, they are also separately insured under FDIC and SIPC regulations.

MoneyLion’s world-class media arm ensures that users receive high-quality, curated financial content, enhancing their overall experience and promoting financial literacy.

Sponsored Advertising Content:

Advertorial or Sponsorship User published Content does not represent the views of the Company or any individual associated with the Company, and we do not control this Content. In no event shall you represent or suggest, directly or indirectly, the Company's endorsement of user published Content.

The company does not vouch for the accuracy or credibility of any user published Content on our Website and does not take any responsibility or assume any liability for any actions you may take as a result of reading user published Content on our Website.

Through your use of the Website and Services, you may be exposed to Content that you may find offensive, objectionable, harmful, inaccurate, or deceptive.

By using our Website, you assume all associated risks.This Website contains hyperlinks to other websites controlled by third parties. These links are provided solely as a convenience to you and do not imply endorsement by the Company of, or any affiliation with, or endorsement by, the owner of the linked website.

Company is not responsible for the contents or use of any linked website, or any consequence of making the link.

This content is provided by New Start Advantage LLC through a licensed media partnership with Inquirer.net. Inquirer.net does not endorse or verify partner content. All information is for educational purposes only and does not constitute financial advice. Offers and terms may change without notice.