Advertorial or Sponsorship User published Content does not represent the views of the Company or any individual associated with the Company, and we do not control this Content. In no event shall you represent or suggest, directly or indirectly, the Company's endorsement of user published Content.

The company does not vouch for the accuracy or credibility of any user published Content on our Website and does not take any responsibility or assume any liability for any actions you may take as a result of reading user published Content on our Website.

Through your use of the Website and Services, you may be exposed to Content that you may find offensive, objectionable, harmful, inaccurate, or deceptive.

By using our Website, you assume all associated risks.This Website contains hyperlinks to other websites controlled by third parties. These links are provided solely as a convenience to you and do not imply endorsement by the Company of, or any affiliation with, or endorsement by, the owner of the linked website.

Company is not responsible for the contents or use of any linked website, or any consequence of making the link.

Mitigately: Reviews and Ratings

Debt is a burden that weighs heavily on millions of Americans. For many, it can feel impossible to tackle on their own. However, companies like Mitigately are revolutionizing the debt relief process and helping people reclaim their financial freedom.

Negative reviews can significantly impact businesses by decreasing sales, customer trust, and profitability. Mitigately’s positive reputation helps mitigate this impact by providing exceptional service and encouraging positive reviews.

This article will explore Mitigately‘s services through real user reviews, online reviews, comparisons to other options, tips for maximizing results, and the life-changing impact of becoming debt-free. By the end, you’ll understand why Mitigately has earned rave reviews and why it could be the key to unlocking your financial future.

How Mitigately Works

How Mitigately Works

Before diving into reviews, let’s break down Mitigately’s simple process in four easy steps:

- Sign Up. Mitigately’s online assessment takes just 6½ minutes to complete. You’ll provide some basic financial details without needing to speak to anyone.

- Debt Analysis. Mitigately uses AI to analyze your debts and income. Within days, they’ll identify your situation’s best-customized relief program. Mitigately’s AI also evaluates actual performance data to ensure the most effective and fair assessment, similar to a performance review process. It avoids recency bias by evaluating performance data over time, ensuring a comprehensive and objective analysis.

- Enroll in Your Solution. Whether it’s debt consolidation, settlement, or a hybrid plan, enrolling is simple through Mitigately’s online portal.

- Achieve Debt Freedom. Mitigately handles all negotiations with creditors from there. Most users finish paying off debts within 24-48 months while saving thousands.

The best part? Mitigately’s services are free until debts are settled—you only save money using them. There are no long phone calls or handing your details to strangers. With Mitigately, debt relief is refreshingly simple.

Real Success Stories and Online Reviews

Now that the process is clear, let’s hear directly from Mitigately users about their debt-free journeys and how these success stories help counteract bad reviews:

- “Mitigately Works” – DM, Arizona

“I was initially skeptical since I’m not tech-savvy with personal finance. I even had some negative feedback at first. But Mitigately delivered—I paid less than half of what I owed! Their AI identified me as qualified for a special program. My debts disappeared while building my credit score back up. I’m grateful Mitigately helped solve an issue I struggled with alone for so long.”

- “Finally Debt Free!” – JF, California

“It took only 5 minutes on Mitigately’s form, and within weeks, I qualified for their Fresh Start program. After years of drowning in credit card bills, all that debt vanished. Now, with a clear financial slate, I’m crushing life goals I never dreamed possible. Thank you, Mitigately!”

- “Saved from a Trap” – MS, Texas

“Car troubles trapped me under a mountain of credit card usage. Interest just kept the debt growing out of control. But Mitigately’s program chopped what I owed in half, letting me break free. Now I spread the word to help others avoid the same money traps.”

These are just a sample of the hundreds of glowing reviews praising Mitigately online. As you’ll see, people from all walks of life have discovered relief through Mitigately’s cutting-edge approach.

Comparing Options

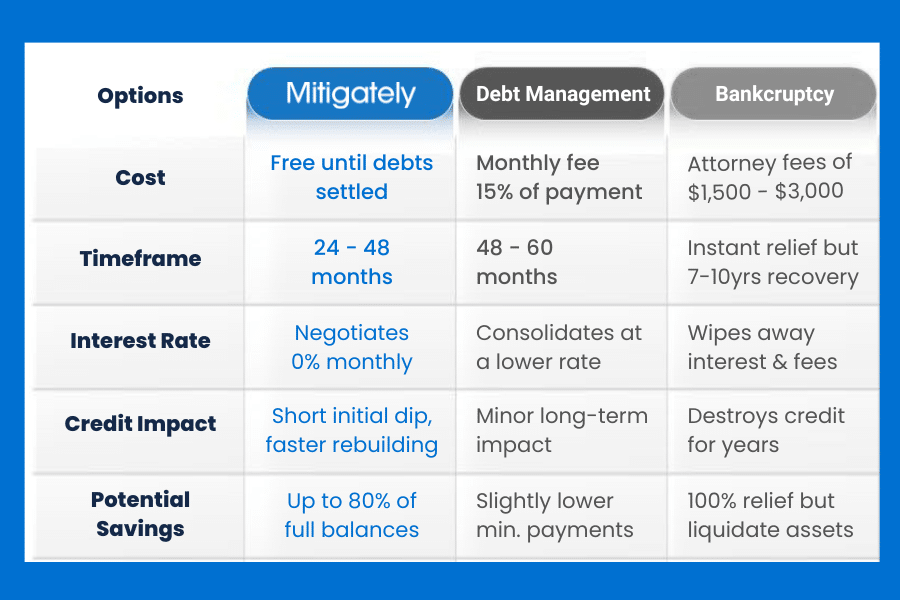

Of course, debt relief has many potential paths. Let’s evaluate Mitigately against more traditional choices:

As the table illustrates, Mitigately has marked advantages. Its AI-powered approach secures top-tier programs that eliminate interest faster while protecting users financially compared to riskier bankruptcy. No other service can match Mitigately’s user-friendly, tech-forward relief process either.

Mitigately’s Credentials: Ensuring a Secure and Successful Service

Trust is paramount in any service dealing with sensitive personal and financial information. Mitigately understands this clearly and works diligently to safeguard clients at every step while delivering unparalleled debt relief results. Additionally, Mitigately’s protocols help mitigate bias in their debt relief assessments, ensuring a fair and transparent process for all clients. Mitigately’s protocols also help mitigate similar-to-me bias in their assessments, ensuring that all clients are evaluated fairly regardless of perceived similarities.

Compliance and Certification

Mitigately maintains an A+ rating with the Better Business Bureau, demonstrating a commitment to transparency and excellent customer service. Compliance certifications like ISO 27001 provide additional assurances, outlining rigorous protocols for securely handling and protecting users’ private data.

Mitigately undergoes regular independent audits to maintain these designations. These certifications also help address and reduce unconscious biases in their processes, ensuring a fair and objective performance management system, similar to how performance reviews aim to mitigate biases such as primacy bias, law of small numbers bias, and similar-to-me bias.

Vetted Representatives to Mitigate Bias

All Mitigately representatives undergo intensive screening involving criminal and educational background checks. Only the most qualified individuals are cut. Continuous training keeps staff up-to-date on evolving regulations and debt relief best practices. This training also helps representatives recognize and overcome their own biases, ensuring they provide unbiased and expert guidance. It specifically helps them avoid primacy bias in their assessments, ensuring initial impressions do not unduly influence their evaluations. Mitigately ensures clients receive only expert guidance tailored specifically to their circumstances.

Legal Expertise in Addressing Unconscious Biases

The company’s in-house debt relief attorneys have decades of combined experience successfully negotiating with major creditors. Their specialized industry knowledge allows Mitigately to maximize debt reductions beyond what individuals could achieve alone. Mitigately’s legal prowess gives their service real teeth when going head-to-head with debt collectors. Additionally, Mitigately’s legal team is trained to recognize and avoid gender bias in their negotiations, ensuring fair and unbiased outcomes for all clients.

Technology on the Forefront

Mitigately remains on the cutting edge of financial technology through research partnerships with top academic programs. Regular updates keep their proprietary AI systems leveraging the latest machine learning innovations. This ongoing evolution drives ever more precise assessments and customized solutions. Mitigately’s AI technology evaluates employee performance data to provide accurate debt relief solutions. Mitigately’s technical acumen outfits them to truly revolutionize an industry mired in archaic methods.

Through stringent vetting, continual staff development, legal acumen, and bleeding-edge automation, Mitigately ensures world-class service delivery and optimal client outcomes. Their multifaceted credibility gives debtors complete peace of mind when partnering for a debt-free future.

Maximizing Relief by Addressing Negative Feedback

Though Mitigately handles negotiations, here are tips for users to maximize their results:

- Follow the Program. Stick to the allocated payment schedule Mitigately provides to maintain positive standing.

- Curtail Other Debt. Once enrolled, refrain from adding new credit obligations that could impact negotiations.

- Check Portal Regularly. Mitigately’s online hub provides program updates you’ll want to monitor closely.

- Attend Education Resources. Use Mitigately’s free financial literacy tools to solidify new money management skills.

- Share Successes. Positive reviews reinforce Mitigately’s value and help others discover this lifeline when overwhelmed by debt. Encourage others to provide positive feedback to counteract any negative comments they may encounter.

With Mitigately’s innovative system behind you and diligence on your part, becoming entirely debt-free is well within reach. Leverage all they offer to expedite that life-changing day of release from your financial burdens.

The Impacts of Freedom

Becoming debt-free opens so many doors, both financially and personally. Consider these common benefits Mitigately customers experience:

- Credit Score Boosts. Eliminating negative payment history allows scores to rebound by 100+ points on average.

- Lower Cost of Capital. With top-tier credit, interest rates drop for loans, mortgages, and more. Large savings compound over decades.

- Peace of Mind. Relief from collection calls and worries frees the mind to pursue goals instead of avoiding creditors.

- More Spending Power. Extra cash flow now goes to savings, investments, hobbies—whatever brings fulfillment instead of debts.

- Better Opportunities. Top credit opens qualifications for perks like 0% balance transfers that build wealth risk-free.

- No Limitations. Unburdened by debts, the future holds potential rather than pressure to escape drowning obligations. Life feels light again.

Mitigately’s success stories also help counteract bad reviews and build a positive reputation, ensuring long-term trust and credibility.

In summary, becoming debt-free through Mitigately unleashes true financial freedom and control over your destiny. The impacts strengthen over a lifetime and benefit not just money but overall well-being.

Conclusion

Mitigately is reimagining debt relief for the better. Bringing cutting-edge automation to an outdated industry makes the empowering steps to financial independence easier than ever.

Anyone stressed by unpaid bills knows living in debt’s shadow has real costs to health, focus, and relationships. Mitigately gives back the gift of freedom through its innovative, people-first approach validated by thousands of rave reviews.

If unresolved debts currently weigh on your mind and spirit, please see if Mitigately holds the key to unlocking your future Potential. Their online tools evaluate situations in a mere 61⁄2 minutes. Why not take those first steps today toward knowing freedom’s rewards for yourself? You owe it to your happiness and security to explore this option.

Through Mitigately, achieving debt-free status is absolutely within reach. Don’t delay reclaiming control over your financial life—past monetary troubles may be ahead once you unburden your best years. Mitigately could be the best investment you can make to live fully.

This overview has inspired you to pursue that brighter path they lead to. Your debt-free future may begin with a simple online form. The time for positive change is now. Share your positive experiences with Mitigately to help counteract negative reviews.

Sponsored Advertising Content:

Advertorial or Sponsorship User published Content does not represent the views of the Company or any individual associated with the Company, and we do not control this Content. In no event shall you represent or suggest, directly or indirectly, the Company's endorsement of user published Content.

The company does not vouch for the accuracy or credibility of any user published Content on our Website and does not take any responsibility or assume any liability for any actions you may take as a result of reading user published Content on our Website.

Through your use of the Website and Services, you may be exposed to Content that you may find offensive, objectionable, harmful, inaccurate, or deceptive.

By using our Website, you assume all associated risks.This Website contains hyperlinks to other websites controlled by third parties. These links are provided solely as a convenience to you and do not imply endorsement by the Company of, or any affiliation with, or endorsement by, the owner of the linked website.

Company is not responsible for the contents or use of any linked website, or any consequence of making the link.

This content is provided by New Start Advantage LLC through a licensed media partnership with Inquirer.net. Inquirer.net does not endorse or verify partner content. All information is for educational purposes only and does not constitute financial advice. Offers and terms may change without notice.