What you should know about Canada’s first carbon pricing rebates for 2024

What you need to know about Canada’s first carbon pricing rebates for 2024 | Photo by Braeson Holland/Pexels

While carbon pricing has been criticized as a primary policy approach to mitigating climate change, the Environment and Climate Change Canada continues to recognize it as the “most efficient means to reduce greenhouse gas emissions while also driving innovation.”

In Canada, the policy collects a federal carbon tax to “pay” the cost of carbon emissions. Then, residents receive quarterly rebates to offset that cost and to encourage them to make energy efficiency investments.

Eligible Canadians are kicking off 2024 with the first of the carbon pricing rebates. “Canadians will start noticing payments arriving in their bank accounts and mailboxes starting Monday, [Jan 15]. These rebate payments are the other half of the carbon pollution pricing system, with eight out of 10 families actually getting more back than they pay,” said Minister of Environment and Climate Change Canada (ECCC) Steven Guilbeault in an official news release.

“The federal pollution pricing system is not only supporting the everyday affordability challenges of Canadians, but is a key part of our plan to fight climate change, contributing about a third of our overall emissions reduction goal.”

Residents of Canada don’t need to apply to receive the rebate officially called the Climate Action Incentive payment. They only need to file their income tax and benefit return to automatically receive the payments through direct bank deposit or by check.

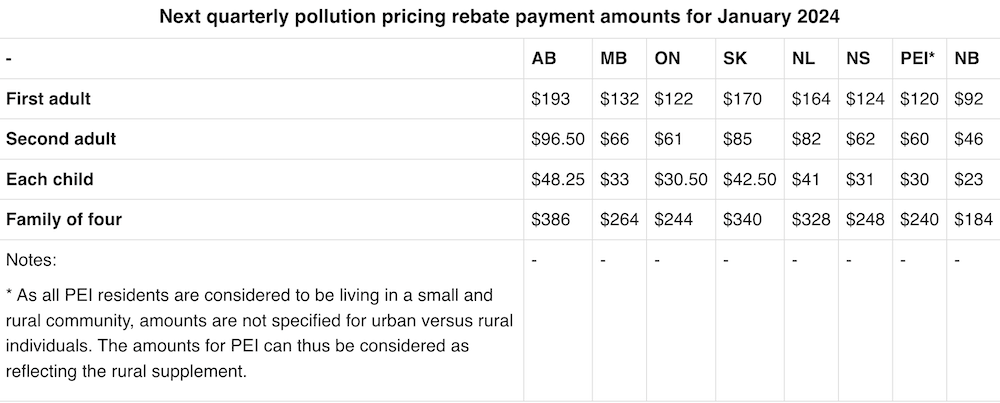

The ECCC has announced the rebate amounts in households in provinces where the federal fuel charge applies. The amount varies for households consisting of individuals, married or common law partners, and families with children under 19. A family of four will receive the following amounts:

- $386 in Alberta

- $264 in Manitoba

- $184 in New Brunswick

- $328 in Newfoundland and Labrador

- $248 in Nova Scotia

- $244 in Ontario

- $240 in Prince Edward Island

- $340 in Saskatchewan

Screencap of the pricing rebate table from canada.ca

“In provinces where the federal pollution price applies, 90 percent of pollution pricing proceeds is returned directly to households through pollution price rebate payments. The other 10 percent is used to support small- and medium-sized enterprises, Indigenous groups, and farmers,” the ECCC says.

“In addition to the pollution price rebate, the Government of Canada continues to support households in cutting energy costs through financial assistance for enhanced insulation, energy-efficient electric heat pumps, and zero-emission vehicles.”

What are your thoughts on the carbon emissions policy?