How Canada’s 4% inflation increase is changing budgets

People shop at a grocery store in Toronto, Ontario, Canada November 22, 2022. REUTERS/Carlos Osorio/File Photo

A daily average cost of eating three meals a day now might cost you more than your usual budget as the inflation in Canada rises at 4%.

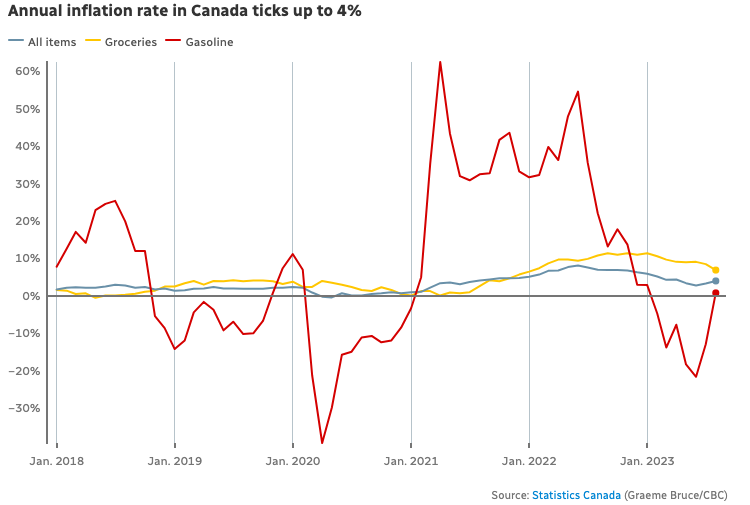

As per Statistics Canada’s report on Tuesday, the inflation rate shot up by 0.7%, and gasoline prices played a major role in this upsurge. Gas prices increased by 4.6% in August alone, and now it is soaring at 0.8% increase compared to the same time last year.

In addition, energy prices don’t stay nice either, as they’re also rising. Like a domino effect, the increase impacts everything from your daily coffee run to the latest gadget you’ve been eyeing for a while.

The Bank of Canada had a 2% target for inflation, but the annual rate is at its highest at 4.4% in April. The main culprit? Gasoline prices keep surging after a 12.9% drop over the last 12 months until July.

Photo from cbc.ca and Statistics Canada

Grocery bill uprise

Your basic needs like food and shelter stay as pricey as they are now due to the 6.9% increase last year. Though the percentage is greater than the total inflation rate, it’s still a slowdown from the increase in grocery bills since January 2022.

As the Bank of Montreal’s Economist Robert Kavcic puts it, “there’s a big distinction between slowing inflation, which is good news and actually outright declines in in prices.”

“If you go from eight per cent inflation to let’s say one or two per cent, that doesn’t mean the price of your grocery bag is falling,” Kavcic said in an interview.

“We’re going to get some relief in terms of the inflation rate, but not necessarily what it costs you to actually go out and buy food and feed your family.”

On a positive note, Canada’s five grocery chains agreed to help the government with its goal to keep prices at bay after their meeting with the finance and industry ministers.

🙈 Ah Shit, Here We Go Again

Inflation in Canada going back up.

From 2.8% in June to 4% in August.

This is a warning to America. pic.twitter.com/V37xijq2PD

— Genevieve Roch-Decter, CFA (@GRDecter) September 20, 2023

It’s not only Canada’s inflation that increased so far; mortgage interest also soared at 2.7% this month and is now at a 30.9% annual increase up to August.

House prices also increased by 6% in the same month, which was increased further by increasing rent prices and interest rates.

You may also like: Your All-In-One Guide to Navigating Mortgage Loans

Amid this, Canadian Prime Minister Justin Trudeau’s government presented a legislation aimed at propelling the building of rental properties to curb the increasing cost of living.

This unexpected high inflation can potentially cause another Bank of Canada rate hike. While the odds of it happening are at 50/50, a lot can still transpire before the next rate decision on October 25, which includes another inflation number for September.

For now, tightening the belts for unnecessary expenses can somehow help consumers stay afloat on the influx of inflation increase in Canada.